Trade Plan for 12/22-12/26

Jingle Bells or Silent Night

Last week I amped up my bear bias noting bearish divergence across multiple timeframes. I shorted resistance on Monday and finally (finally) price action backtested my ‘lipstick’ support on Wednesday where I closed all shorts but a small runner. 💰💰💰

Ultimately I decided not to long my support, but to wait for the CPI data (😑). The week closed essentially flat week over week ($SPX closed + 0.1%), but the continuous $ES/SPX futures chart was aided by a contract roll that boosted levels by approximately 60 points. This week is a holiday week, which are typically low volume – but that doesn’t mean there won’t be tradable volatility/price action as large speculators and funds reposition for the coming new year.

I was slight bear bias for the precious metals and shorted silver on Thursday, but the momentum was too strong and it closed the week near highs.

I maintained a neutral bias for $CL/Crude Oil futures as I await confirmation one way or the other before I can have more conviction.

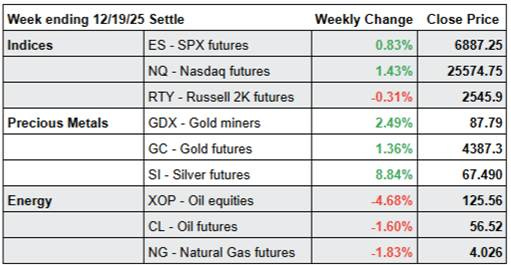

Summary of Market Action Last Week:

· The indices rallied on last week’s open, but declined into midweek. The low for the week was put in Wednesday and we saw a significant bounce into the rest of the week. $NQ/Nasdaq futures outperformed slightly, while $RTY/small caps futures showed relative weakness.

· $GDX/Gold miners outperformed the indices for the second week in a row. $SI/silver futures closed the week near highs.

· $CL/Crude Oil futures dropped, while $XOP/oil equities was the underperformer for the week losing ground against the indices.

Here’s how last week closed out (includes a futures contract roll to the upside):

For the week ahead (12/22 – 12/26/25)