Trade Plan for 12/15-12/19

Don't They Know It's Christmas Time?

I chose to have a minimal bearish bias last week, as I felt we were very close to the bears’ last chance before all time highs. Still, I took a few $RTY/small caps futures longs early in the week into FOMC day 💰💰 and then scalped a great $NQ/Nasdaq futures short on Wednesday as well. At the end of that day futures breached above my resistance levels, but the decline after $AVGO earnings set up what I call a ‘fakey breaky’ and the short on Friday did not disappoint. ✅💰

As is usual for FOMC decision weeks, precious metals generally traded with the indices, but we saw significant divergence on Thursday evening with metals showing relative strength into Friday morning. But just like the indices, we saw a significant liquidity drop into the end of the week.

I maintained a neutral bias for $CL/Crude Oil futures as I await confirmation one way or the other before I can have more conviction.

Summary of Market Action Last Week:

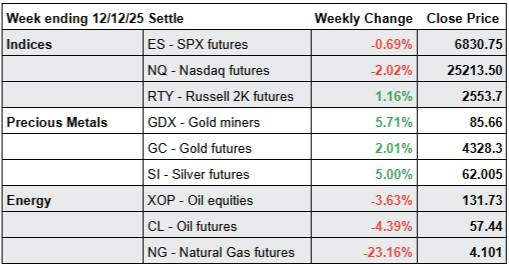

· The indices declined into midweek before a rally that topped in early futures trading on Thursday. Friday trended down leaving both $ES/SPX futures and $NQ/Nasdaq futures in the red for the week. $RTY/small caps futures also lost ground on Friday, but managed to hold positive for the week thanks to some early outperformance.

· $GDX/Gold miners made up for the previous week outperforming the indices. $GC/gold futures and $SI/silver futures were strong until Friday morning’s drop, but still led gains for the week.

· $CL/Crude Oil futures and $XOP/oil equities dropped back into neutral consolidation territory.

Here’s how last week closed out:

For the week ahead (12/15 – 12/19/25)