Trade Plan for 12/12-12/16

Santa Claus rate pause or Grinch bear on a tear

Follow @CordovaTrades✨ and collaborator @SLMacro on Twitter and please share if you find our work valuable.

Last week I was lowest confidence bullish bias for the market, but price action for $ES/SPX futures never got above my immediate resistance of 4078, so I first tried a small long in my 4010 key pivot area and then waited until 3920 where I tried once again. My weekly key pivot of 4010 was backtested from below on Friday, but price was rejected there.

I was more bullish on precious metals and miners. $GDX closed the week slightly red, but gold eked out a small gain and silver gained nicely on the week. The high of the week for silver was 23.90 coming close to my 24 target.

I increased my bearish confidence on both oil and oil stocks. They closed the week down substantially from last week.🏆

This week I map out key pivots for the market and precious metals for what is likely to be a volatile week ahead and I share my plan for when I will flip to a bullish bias for oil. @SLMacro looks back at 2022 and the performance of The Moneymaker both in macro outlook and positioning.

Summary of Market Action Last Week:

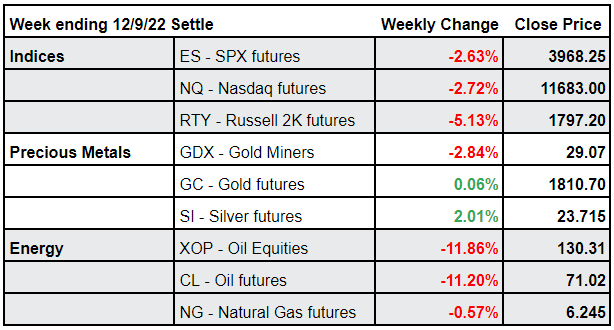

Price action for the indices hardly ticked over the opening print Sunday night and continued lower until a reversal on Wednesday. Friday’s price action looked potentially constructive until the last hour selloff. $ES/SPX futures, $NQ/Nasdaq futures and $RTY/small caps closed red for the week. $RTY/small caps closed down by the most and at its lows.

$GDX (gold miners) closed the week slightly down from last week’s close, but gold and silver settled green on the week. $SI/silver futures led the upward momentum.

$CL/Crude Oil futures and $XOP/oil equities closed the week down substantially.

Here’s how the week closed out:

For the week ahead (12/12 - 12/16/22)