Trade Plan for 12/1-12/5

Did the turkey rally steal the Santa rally?

I started out last week with a neutral bias and general plan to either buy a flush or short at the second shoulder area for what I perceive to be a potential head and shoulders building on the daily & weekly $ES/SPX futures charts.

Price action broke out above the range I was watching, but it’s still possible that the head and shoulders structure is intact and topping a bit higher. This week I look at the monthly charts and where that weekly structure would be invalidated.

I was expecting precious metals to consolidate more before breaking out so I started the week looking for shorts, but noted a possible bull flag on the Silver daily chart and the breakout on Wednesday was fierce with momentum continuing through the holiday trading.

I was also neutral for $XOP/oil equities. We have seen them coiling for months, so I’m waiting for confirmation one way or the other.

Summary of Market Action Last Week:

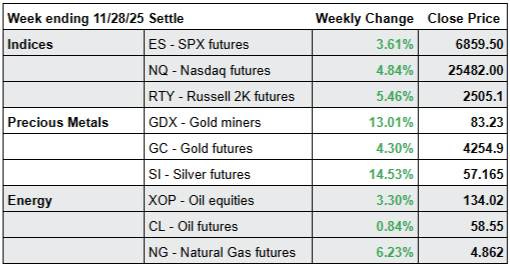

· The indices gapped up and trended up each day last week (!) resulting in an impressive rally inside a holiday shortened week. $RTY/small caps futures showed relative strength for the second week in row.

· On Wednesday precious metals and $GDX/Gold miners broke out and continued rallying into holiday trading.

· $CL/Crude Oil futures booked a small gain, with $XOP/oil equities ascending just slightly behind the indices.

Here’s how last week closed out:

For the week ahead (12/1 – 12/5/25)