Trade Plan for 1/20-1/24

Inauguration Pump or Sell the News Dump?

Last week I started the week neutral but the general plan on Sunday evening/Monday was short $ES/$SPX futures to 5834.50 if $ES remained below 5869.50. The high Sunday night at 5867.50. 🎯💰. There was a weekly cluster of supports there down to 5817.5. I tried longs there during RTH on Monday and because it closed over 5860 both Monday and Tuesday (with a higher low), I remained long biased for the remainder of the week, but I did take some cheeky short scalps along the way.

Here’s a snapshot of my hourly chart I streamed live on Discord:

The daily $TSLA bullflag I alerted you to last week here broke out on Wednesday. Here is the updated chart and levels to watch this week:

I was also once again slightly bullish for both precious metals and crude and my levels worked quite well across the board. 🎯💰

Summary of Market Action Last Week:

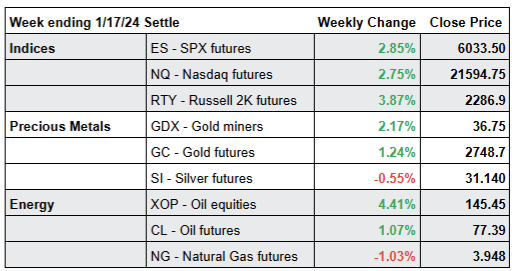

The indices dipped Monday, but that dip was to be bought and the indices continued higher throughout the rest of the week. $RTY/small caps showed relative strength once again.

$GDX/gold miners continued higher along with $GC/Gold futures, but $SI/Silver futures took a slight hit on the week.

$XOP/oil equities continued to outperform for the second week in a row, but the momentum for $CL/Crude Oil futures slowed.

Here’s how last week closed out:

For the week ahead (1/20 - 1/24/25)