Trade Plan for 1/2-1/6

New hope or auld lang syne?

Follow @CordovaTrades✨ and collaborator @SLMacro on Twitter and please share if you find our work valuable.

Happy New Year!

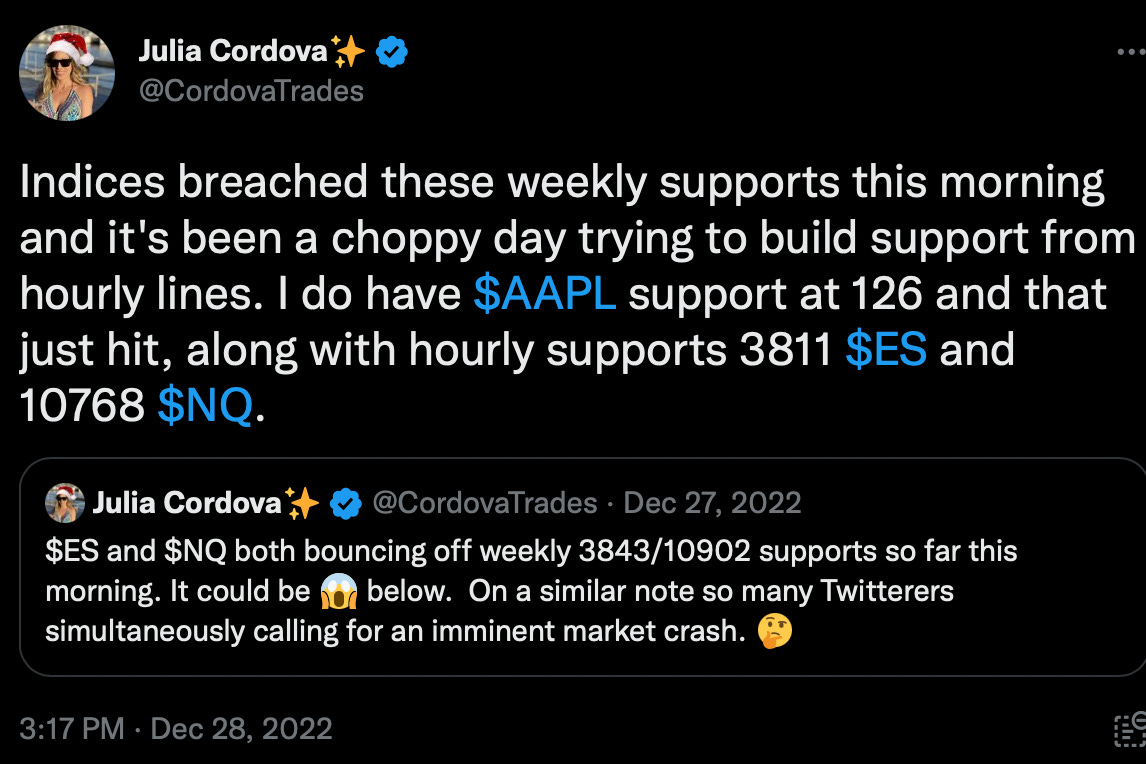

Last week’s low volume shortened holiday week printed small range weekly candles in the indices as well as for precious metals and oil. I was looking to BTD last week, but that strategy was not without challenges when $NQ/Nasdaq futures fell below my weekly support. I then looked at the $AAPL chart and hourly indices charts to try and find support into what I thought may be an end of week run up.✅

I maintained a bullish outlook for precious metals and a bearish outlook for oil, as it has yet to close above the technical threshold where I will think that a bottom could be in.

This week is another holiday abbreviated week. Normal futures trading will resume at 6pm ET Monday and the markets will be open Tuesday morning as usual.

Summary of Market Action Last Week:

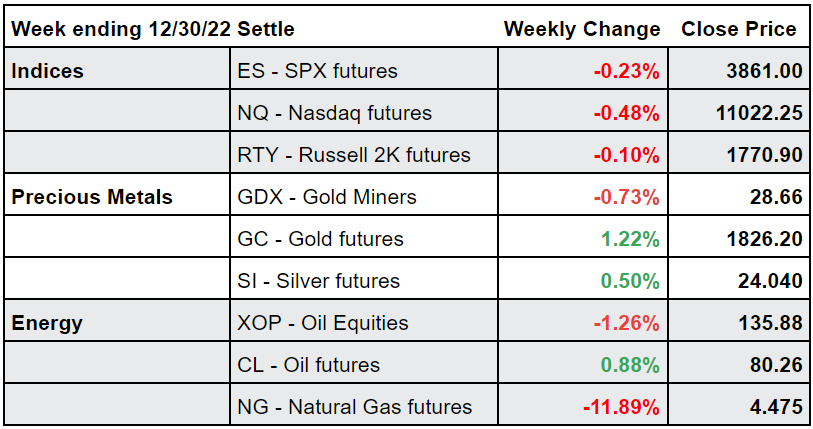

$ES/SPX futures printed an inside weekly candle, but $NQ/Nasdaq futures made a lower low and lower high. $RTY/small caps squeaked by holding a higher low. All 3 closed moderately lower.

$GC/gold futures and $SI/silver futures outperformed the indices once again by posting gains, but $GDX (gold miners) closed the week red.

$CL/Crude Oil futures also closed out with another gain that didn’t manage to carry over for $XOP/oil equities, which closed slightly in the red.

Here’s how last week closed out:

For the week ahead (1/5 - 1/9/23)