Trade Plan for 11/3 - 11/7

Will November deliver a PUMP-kin or gobble up gains?

Last week I felt that overall price action for the indices did not look bearish and noted unusual price action as a sign of short term strength. We saw that short term strength into the first half of the week after a gap up and continuation higher. That said, I took 2 tremendously profitable shorts last week.

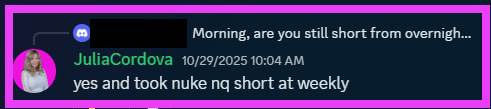

That was Wednesday morning. I took a ‘nuke $NQ/Nasdaq futures short’ at my weekly $NQ 26325 level. The high of day was 26326.50 🎯💰💰💰 and we saw an almost 300 point decline to the lows.

Here’s where I took profits:

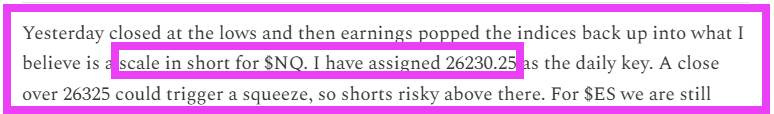

My second short was Friday morning as I specified in my morning note:

I scaled in short on the open and then added on a break of support. ✅💰 I closed the weekly flat.

I kept my short bias for precious metals, my levels performed very well and they closed the week red. I was neutral for $CL/oil futures.

Summary of Market Action Last Week:

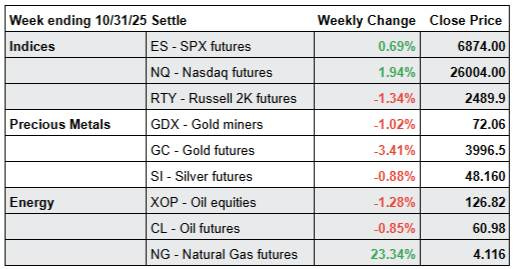

· The indices gapped up to start the week and we saw turbulent chop into the FOMC and tech earnings. $NQ/Nasdaq futures held the most relative strength while $RTY/small caps lost ground each day into Friday,

· $GDX/Gold miners, $GC/gold futures and $SI/silver futures gapped down but each bounced substantially from lows. Still they closed red on the week, with $SI showing the most relative strength.

· $CL/Crude Oil futures chopped sideways for the most part and $NG/Natural Gas futures rallied aided by a contract roll upwards.

Here’s how last week closed out:

For the week ahead (11/03 – 11/07/25)