Trade Plan for 11/24 - 11/28

Will the market get stuffed in time for Thanksgiving?

Last week I wanted to be more bearish than I thought the charts looked going into the week which may seem disappointing given the decline, but ultimately I believe my neutrality allowed me to trade optimally in what turned out to be both a volatile and down week. My daily plans worked very well to avoid getting trapped and capture moves bidirectionally. When the large downdraft on Thursday dropped into monthly support, I longed overnight with a plan to add lower.

That trade was a big winner on Friday, along with an $RTY/small caps futures long I added in the morning (and ended up with a disproportionately large position) because of the relative strength.💰

I also covered some of one of my big tech shorts, $MSFT, that I’ve been holding patiently since shorting @550.💰

I was more bearish for precious metals, and took several shorts through the course of the week. ✅

I did not trade crude last week because I didn’t like the setups, but it did reject my key level.

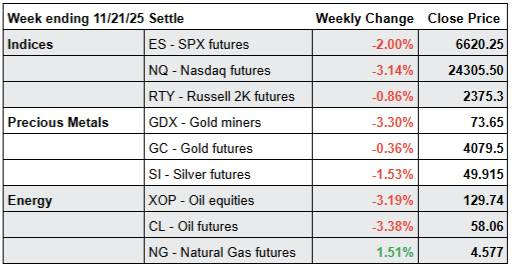

Summary of Market Action Last Week:

· The indices hit their highs for the week on Monday and lows on Friday morning before a bounce. There was volatility in between with an $NVDA earnings bounce, but that bounce was faded in an impressive fashion. $RTY/small caps futures lost the least ground last week, while $NQ/Nasdaq futures was the worst performer.

· $GDX/Gold miners pared back with the indices, with both $GC/gold futures and $SI/silver futures also in the red for the week.

· $CL/Crude Oil futures and $XOP/oil equities declined as well.

Here’s how last week closed out:

For the week ahead (11/24 – 11/28/25)