Trade Plan for 11/20 - 11/24

Turkey, stuffing, pie and chop salad in the market

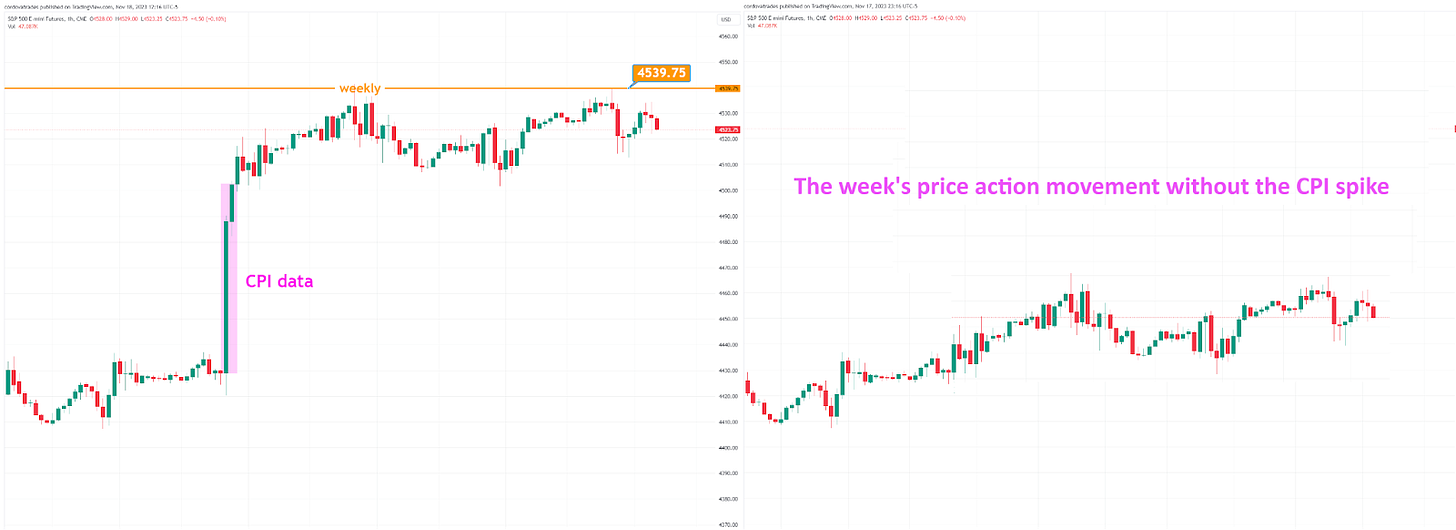

Last week felt like chop, but you would never know it by looking at the weekly candle. As a sanity check, here’s hourly price action with and without the CPI spike. It was a slow grind sideways/ marginally up with a spike in the middle:

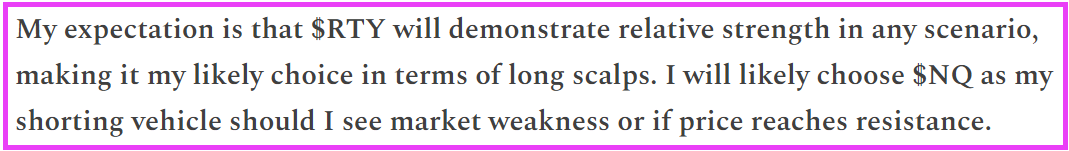

My overall plan last week was to short resistance levels, which I did, and my upper resistance of $ES/SPX futures of 4539.75 worked very well to contain price which maxxed out at 4541.25. 🎯 I surmised that regardless of path, $RTY/small caps futures would show relative strength (which it handily did) ✅ and $NQ/Nasdaq futures would show relative weakness. I took a good $NQ short at my resistance there as well and after hitting my resistance, it did show relative weakness. ✅

My metals trade (long $SI/silver futures) ended last week right on the edge of breakdown and I could not technically find a way to call precious metals ‘bullish,’ despite me being in the long trade. Instead I held conviction waiting for the daily close on Monday and gave levels for recovery. Both silver and gold held strong breaking above early in the week. ✅ 💰

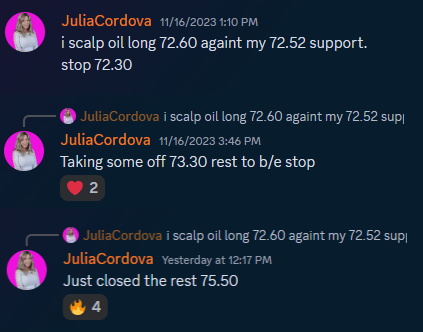

While I have been overall bearish on oil, I thought that oil could potentially pop last week. That was clearly incorrect, but I did long scalp $CL/crude futures at my 72.52 support (low of week was 72.37🎯 and did very well doing so.✅💰

This week $SLMacro reiterates his thoughts on “Higher for Longer.”

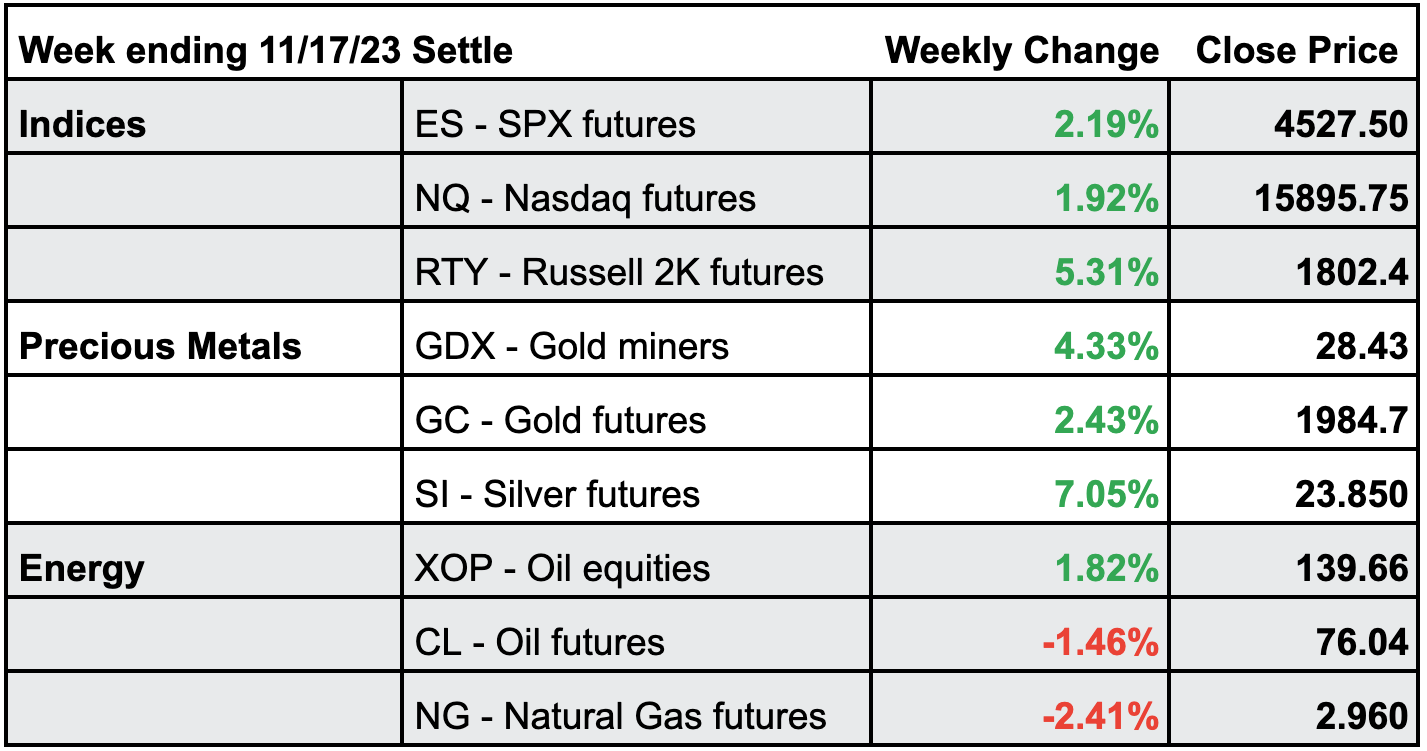

Summary of Market Action Last Week:

$ES/SPX futures and $NQ/Nasdaq futures chopped mildly upwards this week both before and after a CPI data spike and held gains on the week. $RTY/small caps futures showed impressive relative strength before topping out on Wednesday and then rallying again on Friday.

$GDX/gold miners bottomed on Monday and then progressed upwards each day. $SI/Silver futures showed relative strength against $GC/gold futures this week.

$CL/Crude Oil futures declined on the week once again, but got a good sized bounce from the lows. $XOP/oil equities held strength.

Here’s how last week closed out:

For the week ahead (11/13-11/17/23)