Trade Plan for 1/12-1/16

Last week no news was good news, but it's always about the levels

Last week I identified 3 points of confirmed bearish divergence for $ES/SPX futures, which I find to be a high probability setup in general, but I did not assign my highest confidence for good reasons. The first was the outperformance in strength for $RTY/small caps on the previous Friday and the second was $ES/SPX futures holding a key breakout level the week before. Instead I decided to keep an open mind so long as price action stayed above or recovered 6925.50. Friday was the last chance for bears last week, but no news from the Supreme Court turned out to be good news for the indices and we saw the week close near highs.

I was neutral for precious metals, but noted a potentially bullish hourly setup for $GC/gold futures that came to fruition and identified 4hr bullflags for both $GC/gold futures and $SI/Silver futures midweek, and we also saw a breakout there.

I scalped $CL/crude oil futures to the upside a few times last week and it rejected near perfectly off of my weekly key of 59.86. ✅🎯

Summary of Market Action Last Week:

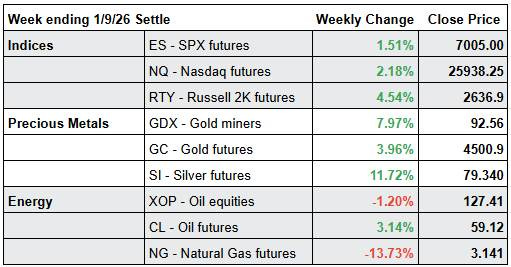

· The first full week of trading for 2026 was a positive one for indices. The first part of the week was strong, with a dip midweek that was bought and Friday rallied after no news from the Supreme Court was good news. $RTY/small caps futures outperformer substantially.

· $GDX/Gold miners also rallied to highs and the metals surged higher.

· $CL/Crude Oil futures rallied, while $XOP/oil equities lost groud for the week.

Here’s how last week closed out (includes a futures contract roll to the upside):

For the week ahead (1/12 – 1/16/26)