Trade Plan for 11/17-11/21

Was that a Dead Cat Bounce or is there a 9th life incoming?

Last week I went into the weekend with an $RTY/small caps long I had bought near the lows on Friday:

I held because the price action there triggered one of my favorite setups that is high probability. My intention was to hold into midweek as I was biased for upside into Wednesday.

Sunday evening we saw a gap up in futures across all of the indices and $RTY churned upwards into Wednesday when I closed ½ close the the highs and the other ½ when it looked to me like everything was reversing.

Wednesday was the high for all of the indices.✅💰

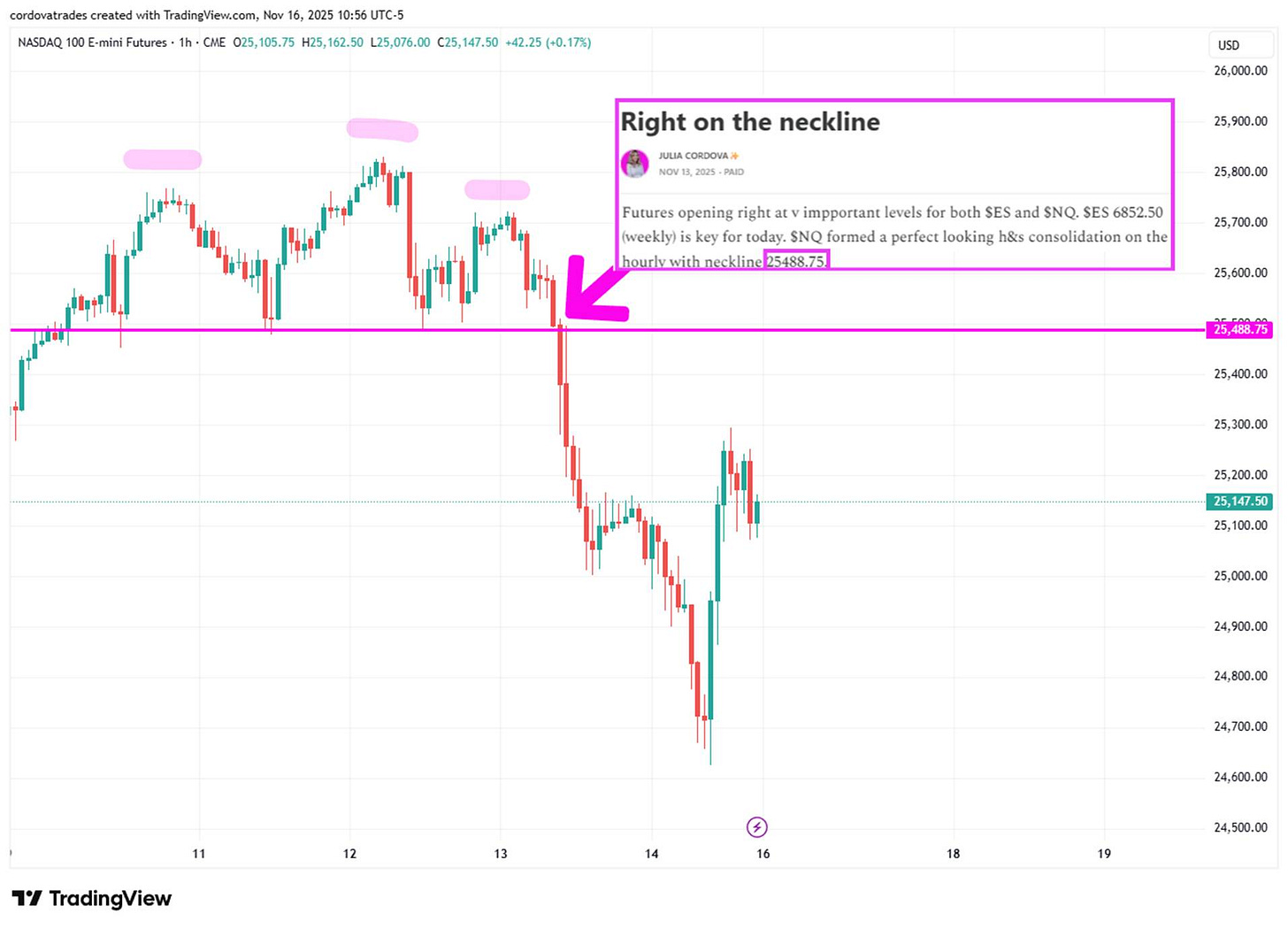

On Thursday’s morning note I identified a near perfect head and shoulders formation on $NQ/Nasdaq futures took a tremendous short into the near lows.💰💰💰

I tried a long near the bottom at a daily support, but squeaked out of it when I didn’t see strength. Friday morning I noted that we were opening on weekly support levels:

That was an amazing weekly level for $NQ.🎯 Because I was looking for possible rotation and perhaps a ‘stick save’ for the indices, I took an $RTY long again on Friday morning. It was a profitable trade and it did well, but the small caps rotation trade was disappointing despite $XOP/oil stocks outperforming indices.

I was neutral for both precious metals and crude oil. But I did take a silver short midweek a bit early and stopped out. 😑

Summary of Market Action Last Week:

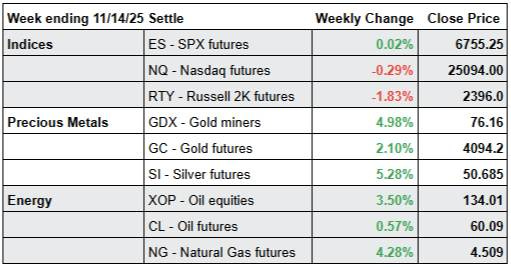

· The indices gapped up to start the week and rallied into highs on Wednesday. On Thursday we saw a sharp decline continuing into the evening and resulting in a large gap down Friday morning. That gap down was bought and both $ES/$SPX futures and $NQ/Nasdaq futures recovered to close near flat, while $RTY/small caps futures also bounced, but less convincingly.

· $GDX/Gold miners was the relative outperformer last week, with both $GC/gold futures and $SI/silver futures holding gains despite lackluster indices.

· $CL/Crude Oil futures eeked out a small gain week over week, but $XOP/oil equities performed well relative to both the commodity and the indices.

Here’s how last week closed out:

For the week ahead (11/17 – 11/21/25)