Trade Plan for 11/10-11/14

Will the bulls go cold turkey or get a PUMP-kin pie?

Last week I had a more bearish bias than I had in long while, but of course levels based. I had gone long $RTY/small caps futures overnight on Tuesday at 2420-2422.

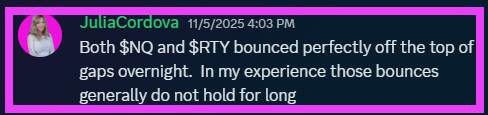

It was a great long and I held it into midday on Wednesday, but I noted on Wednesday afternoon that despite the rally we saw, I did not believe that the bounce would hold.

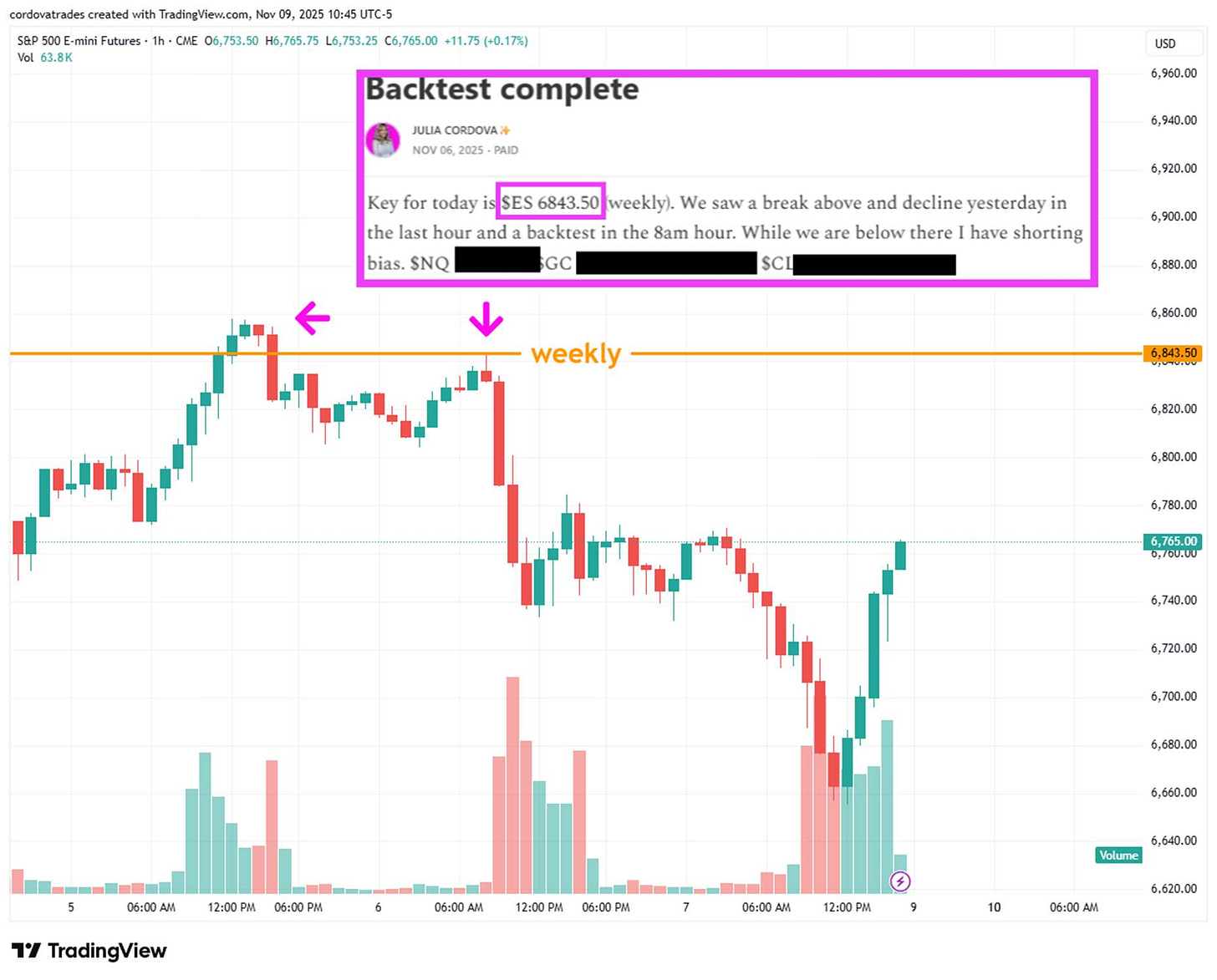

My weekly ‘key’ level was $ES/SPX futures 6843.50 and for me was the bull/bear fulcrum. Price action breached above on Wednedsay but fell back below by the end of the day. On Thursday in the 8am hour we saw a near perfect back test from below and that set up a great short for Thursday.

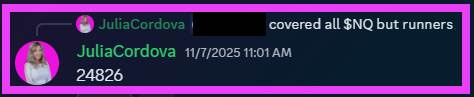

I closed most shorts on Friday close to the lows.

I hadn’t intended on longing, but when price breached back above supports I took a long as well.

I was neutral and levels based for both precious metals and oil.

Summary of Market Action Last Week:

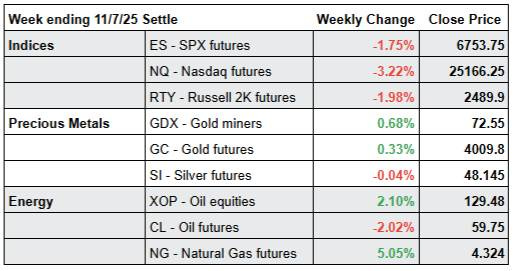

· The indices chopped sideways early in the week before losing daily supports and then stair stepping downwards into Friday before we saw the 2nd bounce of the week. $NQ/Nasdaq futures lost the most ground last week with the Mag 7 being hit hard.

· $GDX/Gold miners and $GC/gold futures managed to close the weak green despite overall weakness in the indices. $SI/silver futures closed flat with a nominal decline.

· $CL/Crude Oil futures declined last week, but notably $XOP/oil equities was green and showed the biggest gain last week.

Here’s how last week closed out:

For the week ahead (11/10 – 11/14/25)