Trade Plan for 10/7-10/11

FOMC minutes, CPI and PPI coming up!

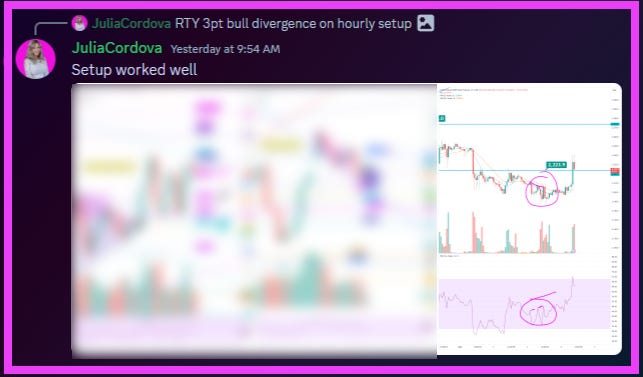

$ES/SPX futures and $NQ/Nasdaq futures chopped downwards into Friday’s data, but the reaction to positive data on Friday morning allowed both to close slightly green for the week - essentially flat week over week. My plan last week was to look for $NQ shorts as it remained below my weekly resistance level, but also to buy the bottom of the $RTY/small caps futures bullflag that I saw forming on the daily chart. I took some great $NQ shorts through Thursday and then bought the bottom of the $RTY daily flag. The daily $RTY long setup was even stronger because of a triple bullish divergence setup on the hourly chart:

I was optimistic for buying precious metals dips once again and continued to look for a $CL/Crude Oil futures squeeze above my key level of 72.52. ✅✅

Summary of Market Action Last Week:

The indices chopped downwards into Thursday and then recovered on Friday. $ES/SPX futures and $NQ/Nasdaq futures closed nominally green week over week, while $RTY/small caps futures settled with a slight decline.

$GDX/gold miners lost ground despite $GC/gold futures closing flat and $SI/Silver futures booking a gain.

$XOP/oil equities and $CL/Crude Oil futures were impressive outperformers for the week recovering from recent persistent selling.

Here’s how last week closed out:

For the week ahead (10/07 - 10/11/24)