Trade plan for 10/6-10/10

Last week $ES/$SPX futures finally hit my weekly resistance on Friday after many weeks of a gradual drift upwards. It broke out on the hourly briefly, before a sharp reversal lower. Now the question is whether this week’s equivalent resistance holds.

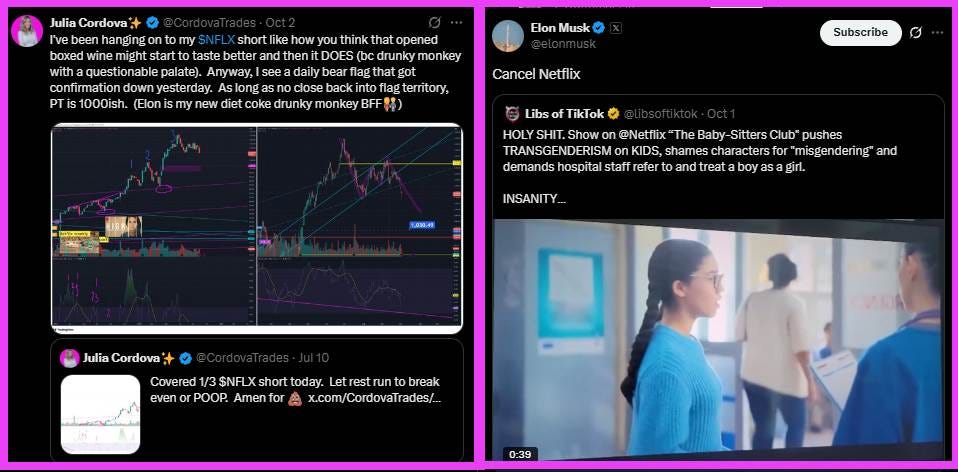

I have continued to swing some overbought tech shorts, as opposed to shorting the indices directly for any extended period of time, because I believed (and still believe) that trade strategy is the safest contrarian bet in the intermediate term. Last week Elon seemed to have helped my cause with one of those shorts. It’s like he knew I was watching for a bear flag confirmation breakdown👾👽🛸:

$GDX/gold miners near perfectly backtested and held my highest weekly level this week, so like the indices this week is all about if the equivalent weekly level, now support, will hold.

$CL/Crude oil futures didn’t quite get enough of a breakout to instill high confidence in longs for last week, and this week we’ll see whether the slight breakdown will have better continuance.

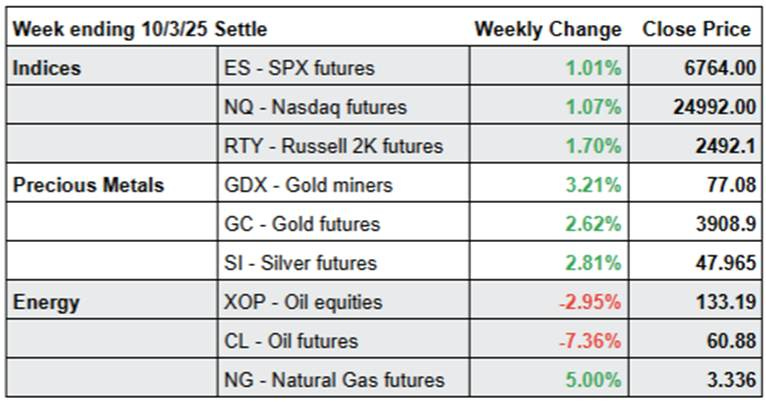

Summary of Market Action Last Week:

· The indices climbed daily until Friday, when after a morning breakout, both $ES/$SPX futures and $NQ/Nasdaq futures both reversed closed slightly red for the day. $RTY/small caps futures was the relative strength winner for the week.

· $GDX/Gold miners outperformed the broad market for the sixth time this week. $SI/Silver futures and $GC/gold futures also outperformed.

· $CL/Crude Oil futures and $XOP/oil equities reversed course from last week’s rally in volatile trading.

Here’s how last week closed out:

For the week ahead (10/6 - 10/10/25)