Trade Plan for 10/28 - 11/1

Here we go

Last week my big picture plan was to continue watching for strength in $RTY/small caps futures and also to watch for $NQ/Nasdaq futures shorts, but it was clear on Monday that $RTY was not able to hold support and it failed lower supports as well.

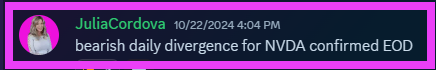

In my weekly note I included my $NVDA chart and wrote:

On Tuesday, the bearish divergence was confirmed:

$NVDA dropped to close -2.81% the next day. ✅

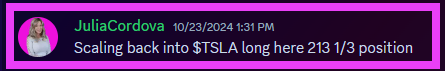

Then on Wednesday, $TSLA dropped further into my buy zone and I decided not to wait for lower before I started scaling in long again. I went long at 213 and change. My plan was simply to add if price were to drop, but it ZOOMED upwards the rest of the week closing at 269.19, a remarkable 21.97% up. ✅💰💰💰

My levels for both metals and crude worked well and overall it was a tremendous week. 👏

Summary of Market Action Last Week:

The tables were turned last week as $NQ/Nasdaq futures went from the worst performer over the last few weeks to first (still only managing a flat close) and $RTY/small caps futures went from the strongest to the weakest giving up more than 3 weeks of gains. $ES/SPX futures chopped downwards for most of the week.

$GDX/gold miners lost ground despite strength in the metals. $GC/gold futures and $SI/Silver futures booked respectable green candles on the week.

$CL/Crude Oil futures rose last week, but $XOP/oil equities continued downwards despite strength in the commodity.

Here’s how last week closed out:

For the week ahead (10/28 - 11/1/24)