Trade Plan for 10/20 - 10/24

After a week of chop will we pop or drop?

Last week I was levels based for $ES/$SPX futures and watching for a recovery above my 6632.00 to start the week. The Sunday evening open was 6632.00 on the nose🎯and we saw a nice rally from there.

The major support I was watching was $ES 6578. Overnight on Thursday into Friday price action bounced there and continued trending up into the close.🎯✅

I have continued to swing some overbought tech shorts, as opposed to shorting the indices directly for any extended period of time, because I believed (and still believe) that trade strategy is the safest contrarian bet in the intermediate term

I suspected that precious metals could potentially see downside based on the $GDX/gold miners price action and also a bear flag that had formed on the $GC/gold futures hourly chart, but soon after the open the price action broke upwards from the structure and we saw incredible momentum to the upside followed by a large descent into Friday morning. Was that a blow off top? I give levels to watch this week either way.

$CL/Crude oil futures continued to breakdown without breaching resistance levels.

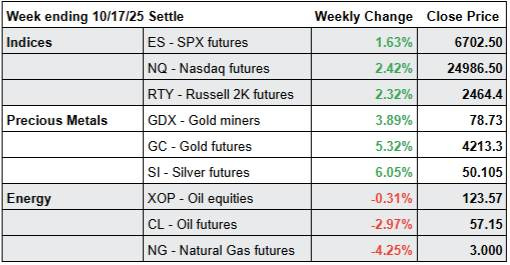

Summary of Market Action Last Week:

· The indices gapped up and chopped all week creating inside candles for both $ES/SPX futures and $NQ/Nasdaq futures.

· $GDX/Gold miners outperformed for the week, but declined sharply from its high. $GC/gold futures and $SI/silver futures posted impressive gains.

· $CL/Crude Oil futures continued to decline, while $XOP/oil equities held on a relative basis with a slight decline.

Here’s how last week closed out:

For the week ahead (10/20 - 10/24/25)