Trade Plan for 10/2 - 10/6

Oktoberfest for Market Unrest

Last week I was overall low confidence bearish✅, but wanted to buy a reasonable dip and had 2 overall levels I was watching. First I had double support at $ES/SPX futures 4326-7. My plan was to take a long scalp from there and leave runners. We bounced initially from that level, but then came below to my other area of interest at 4290. After a washout below, that area was regained with gusto.✅ Amazingly we settled the week right on my ‘double level’ at 4325.50.👽🎯

I was low confidence that precious metals would hold up and have a bullish week, but pointed out that $GDX/gold miners had formed a bear flag on the weekly chart and a significant breakdown could occur once below 28.20. The price action for silver on Friday was… incredible and I will share my thoughts on what I think it means (if anything) for this week.

I was low confidence bearish crude oil and gave levels to watch for strength and weakness. I decided to take a short from my 93.64 resistance. Crude ended the week at 90.74.✅ 💰

Summary of Market Action Last Week:

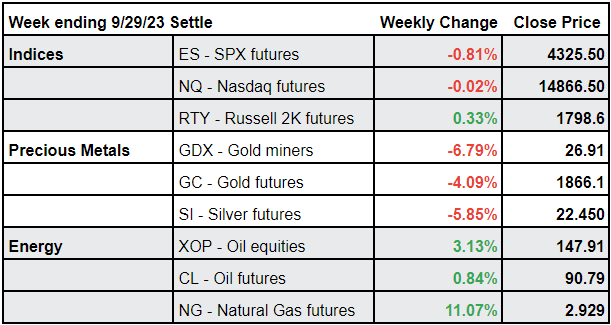

$ES/SPX futures and $NQ/Nasdaq futures had light green days on Monday, followed by heavy selling on Tuesday. They both chopped upwards for the rest of the week. $NQ showed relative strength by managing to close essentially flat, while $ES lost almost 1%. $RTY/small caps futures managed to close marginally green on the week.

$GDX/gold miners gapped down to start the week and never looked upwards. The miners did try and hold lows Wednesday through Friday, but closed close to the low of the week. $GC/gold futures broke down and also closed the week near the lows, along with $SI/silver futures. Both precious metals showed unusual intraday volatility on Friday.

$CL/Crude Oil futures rose substantially into midweek, but then declined to hold a modest gain at the end of the week. $XOP/oil equities followed a similar path, but managed to hold onto a decent gain with relative strength compared to the indices.

Here’s how last week closed out:

For the week ahead (10/2-10/6/23)