Trade Plan for 10/16 - 10/20

Stocktoberfest frightful and/or delightful

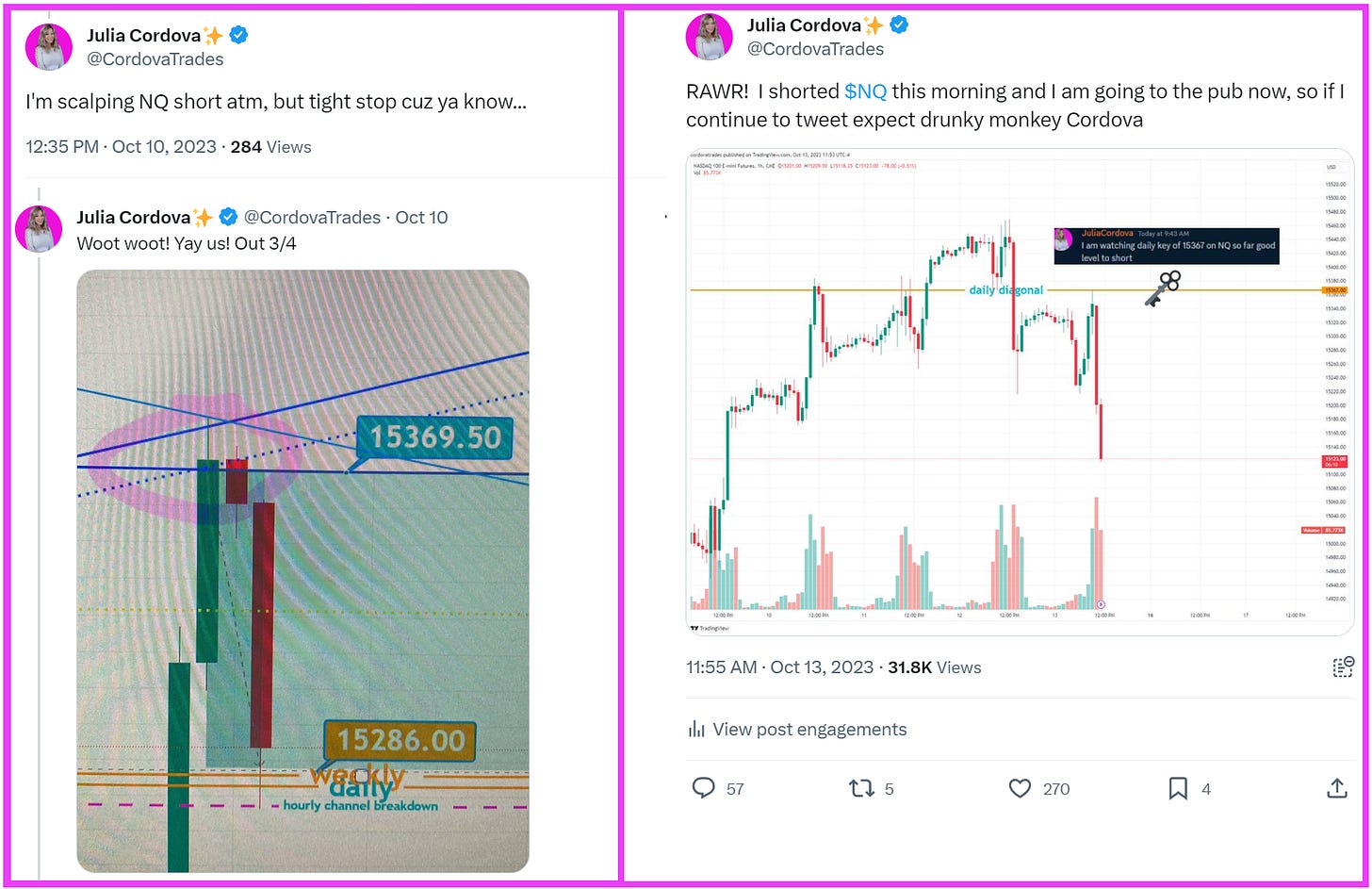

Although it is difficult to ignore the news that came out last weekend and just focus on the charts, that is what traders who rely on technical analysis strive to do. As much of a positive day as Friday was, and despite the obvious contrarian play of being full blown bullish despite world events, I was essentially neutral with a slight bearish bias last week. Despite what I acknowledged as constructive weekly candles, I made a list of technical reasons that prevented me from being ‘unrepentantly bullish.’ Throughout the first part of the week, amid frenzied dip buying, I continued to remind myself that all of the things I listed in my note continued to be valid. That gave me the confidence to defiantly short my resistance levels despite grand bullish sentiment and premature bullish victory laps evident on social media midway through the week. I used a combination of weekly ‘key levels’ and daily support/resistance to successfully navigate shorting against a torrent of buying into resistance. At the close on Friday, markets settled marginally up to down, reflecting well on my neutral to bearish bias.

Not every trade I took was a winner of course, but because I had great levels I kept my stops tight and I hit a couple of homeruns. I performed quite well for the week.

I was more confident in both precious metals and oil being bullish.✅✅ Again, nothing to do with news…both were technically due for more upwards action.

Summary of Market Action Last Week:

The indices opened last Sunday night with a gap down and consolidated overnight before a torrent of buying that lasted into Thursday before a precipitous drop. $ES/SPX futures held onto a slight gain week over week, while $NQ/Nasdaq futures broke its relative strength trend and held essentially flat. $RTY/small caps futures lost ground on the week once again.

$GDX/gold miners outperformed on the week amid impressive gains for precious metals.

$CL/Crude Oil futures gapped up on Sunday night, but declined to fill the gap midweek before a swift rise. $XOP/oil equities reflected crude’s strength and closed with a substantial gain week over week.

Here’s how last week closed out:

For the week ahead (10/16-10/20/23)