The Moneymaker

All That Glitters

Follow @CordovaTrades✨ and collaborator @SLMacro on Twitter

Included today is an essay on our macro gold outlook backed up by data including both headwinds and tailwinds.

Summary of Last Week:

Last week I identified the most high probability trade setups to be that both Gold & Oil would close the week lower despite them being counter trend trades. Gold closed the week 1.56% lower, while Oil closed the week 12.84% lower. (YAY x2! 🎯🎯)

On my public Twitter I alerted for the gold and oil shorts to take some profit Tuesday morning near the lows before each began to retrace upwards with gold finally settling higher and oil lower.

I gave my buy plan for Gold in the open gap of 1887.6-1892.2. The low of the week for Gold 1888.3 (I know, right?🎯) I live alerted that I was scaling in on Twitter and from there it closed up 1.87%. Something for everyone!

My plan also included consideration for a dip buy for Silver in the 24.015-24.155 gap area. The low of the week was 24.045. It closed the week up 2.54%. (C’mon man! 🎯)

I also indicated that I would buy GDX at 37.13, and while that wasn’t the exact low, it closed the week at 39.49 just a few cents above my 39.43 resistance and up from my buy level by 6.36%. (Gazoinks! 🎯)

Because of mixed signals, I specified that I would be trading the indices on a level to level basis. The most intuitive trade for me was an RTY short from the upwards bear flag break at 2126.2. It closed the week down 1.78% from there. (I am running out of exclamatory phrases! 🎯)

I was also bullish Natural Gas and it ended the week up 2.67%.

Here’s how the week closed out across the board:

For the week ahead (4/4 - 4/8/22)

Some weeks are easier than others for me to identify high probability trades so it’s important for me to make the differentiation between having a bias vs identifying high probability setups. Part of the evolution of a trader is not to force something or overtrade but instead to conserve capital until a high probability or good risk/reward opportunity presents itself. Lame, I know, but I am not interested in using the flashy hyperbolic BS I see out there to lure people into the trades that they want to take vs the trades that have a better chance of working in their favor. This week I did not identify any high probability setups, however I do have actionable biases.

Last week ended with a ‘gravestone doji’ candle in $ES (SPX/SPY futures) and a slightly less deathy, but still sickly looking, $NQ candle. $RTY also declined to hold it’s breakout and fell back into the range. Therefore I will trade the indices with a bearish bias on a level to level basis. If the beginning of the week is very bearish I will make sure to take partial profit at support levels while leaving runners. It will be easier to be more aggressive with positioning using reasonable stops if the week opens to the upside. Details in the individual charts.

The most interesting thing about last week was that despite both Gold and Oil closing lower, the GDX (gold miners) and XOP (oil equities) ETFs both closed near the highs and both right on my resistance levels. Most technicians would say that equities typically lead commodities, but I’m not convinced for next week. GDX and XOP are good bet longs if they open above their resistances which will have morphed into supports. Below those supports each will look temporarily bearish. I had been expecting to be able to draw in a bull flag on the gold weekly but I couldn’t find clean slopes to make that happen and there are bear flags on smaller timeframes. I did find a weekly bullflag in Silver and a bull pennant in Oil. While gold and oil have been traveling together so to speak, the relationship is indefinite so it’s best not to rely wholly on the recent correlation.

Natural Gas is near resistance. Plan in the chart.

S&P 500/$ES/$SPX/$SPY

The $ES bullflag follow-through candle turned into what many call a gravestone doji. *Cue an awkward grimace face with a side eye* That said, it’s still hovering right above the 20MA and technically bullish until it isn’t. Above 4535.75 is bullish, but if the week starts out higher than that, 4592.75 would be fantastic to attempt a short. Much above there and flip it and reverse it Missy Elliot style to the moon. Below 4478 and a retest of the bullflag breakout of 4442.50 is very likely. Back inside of the bullflag and gravity will take effect and the heavily supported 4380 OK line will be the target. 4331.25 is the bulls last line of defense against the 4181.75 ‘buy or die’ level.

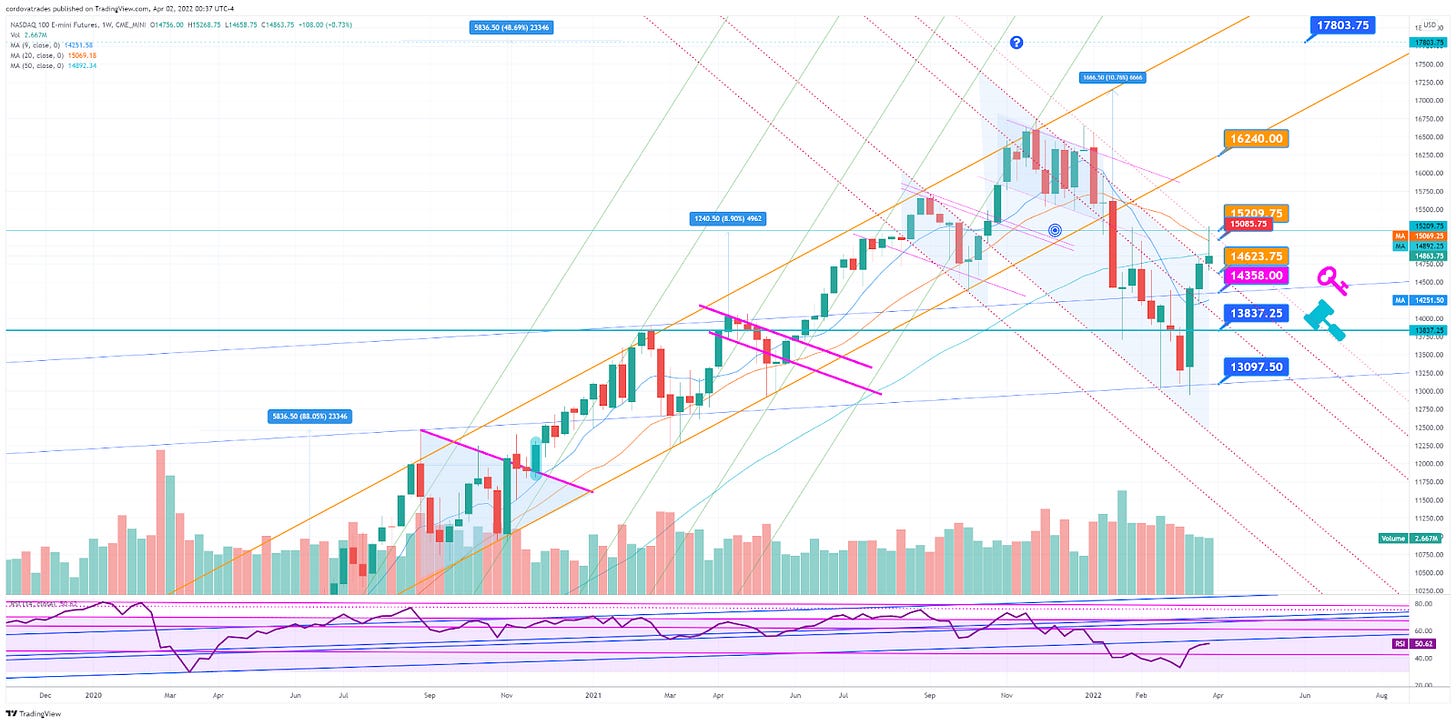

$NQ/US Tech 100/Nasdaq

The weekly $NQ breakout candle doesn’t look as bearish as the $ES candle at a glance, but it’s still super fugly and the overall price action remains below the 9, 20 and 50MAs. Above current price levels I will look to take a short first at 15085.75 then 15209.75 (same level I highlighted last week.) Much above there and best to flip bias or wait until back below to short. 14623.75 is the bullflag breakout retest so it should have some support there if you want to find a place to attempt a long (I’m just saying that to try and be inclusive), but if price falls below, it will likely go to the 14358 🗝️ which will also correspond with the weekly 9MA as support. 14028.75 is the next minor support below (not labeled on chart) and the hammer line support of 13837 I expect to be well defended.

$RTY/$IWM/Russell 2000 Small Caps

$RTY broke *upwards* from the bearflag last week and gave us a really good opportunity to take a nice short from the resistance above. This week the top of the bearflag aligns with the 20MA at 2107.4 Not too far above that 2120.8 is the next resistance and would still be a lower high. Much higher and I will flip bias because 2162.2 is likely. Inside of the bearflag and I only have the 9MA to guide me. It looks to be approximately 2040 for the week.

$GDX/Gold Miners ETF

$GDX weekly has now broken upwards from a bull pennant. It closed the week at 39.49 just above my resistance of 39.43. RSI has also broken out over resistance. If price action opens above, we can now look to 39.43 as support and a touch of the 41.42 level becomes likely. If we get to 44.25, 🍸 for everyone! If price action opens

$GC/Gold futures/$GLD

On the weekly Gold looks to be in a healthy consolidation, but I’ve included the 4hr for your review this week because I am concerned with what could be technically bearish structures forming. 1926 remains the pivotal level to watch on all timeframes. Back above 1939.1 and the 1977 on the weekly, then the 1991.8 4hr🍸looks likely. Very bullish. Below 1926 and I’ll be watching for the tiny gap at 1918.7-1920.3 to be somewhat supportive before the 1900.9 🤖(algo defended) line and then the 4hr price target at 1860.8. In the event of a sudden plunge it is possible for us to see 1821.3 and /or 1744 (I’ll be scaling in all the way down in this unlikely event.)

$SI/Silver/$SLV

Silver has formed a bullflag on the weekly and while still looking bullish closed below my 🗝️pivot of 24.945, but the butt of the candle is supported by a criss cross of MAs so that’s good support. If price action continues bullflagging above last week’s high of 25.795, the next targets are 26.375 and 26.940. Below 24.015 and I’ll look to 23.475 if the 20MA can’t stop it. There remains a gap at 22.475-22.500, that while unlikely to hit, we should be cognizant of in case of extreme volatility.

$CL/Oil/$XOP Oil Equities ETF

I was bearish oil last week and it closed the week just above support, forming a bull pennant. The next support is 98.18 with resistance at 110.41. There are open gaps on both sides of the pennant which should be support/resistance: 91.59-93.53 on the downside and 112.92-113.90 to the upside. XOP closed at 138.48 against my resistance of 138.47. It will be bullish if it opens above there with 138.47 acting as support now. If it opens below and downdrafts I do not have support until 121.46, although the 9MA will come slightly before so it’s a good level to watch.

$NG/Natural Gas/$UNG

Although Natty didn’t exactly touch the top of my channel resistance and ultimately I have a higher price target, it is always prudent to take some profit near resistance while leaving runners and then wait until price action either takes us higher or we reach a strong support to rebuy. If price action opens above and then stays above 5.89, it’s very bullish. Alternatively some may wish to scalp or attempt a short swing there below 5.89. If price breaches 5.89 and falls back below that may also be a good opportunity to attempt a short. I still consider it to be overall bullish so I will avoid trading it to the downside for now.

Macro outlook on Gold: All That Glitters

@SCMacro on Twitter

We are bullish gold this year in the medium term (2-6m), and likely longer term, from a macro perspective. Here’s why:

Gold has historically performed well in periods of high inflation

Gold has a -0.82 correlation with real rates, but despite coming rate hikes, inflation will outpace the fed rate, and real rates will remain negative

Gold has typically underperformed in anticipation of rate hikes and outperformed following the first rate hike of a Fed tightening cycle

Gold tends to perform well when markets have large pullbacks and outperforms the market in recessions.

*Important to note our base case assumption that the Fed raises rates. With a tight labor market, we believe they will follow through with rate hikes in the short/medium term. Significant slowing of the economy later in the year could cause the Fed to reverse direction and take a more accommodative stance.

Historical Price Action of Gold in a Rising Rates Environment

In the last 50 years, when rates were raised, 14 of 19 years (74%) gold was up while S&P was up 12 of 19 years (63%), and gold outperformed S&P 12 of 19 times (63%) – gold avg return 22.82%, S&P avg return 3.36%

When the Fed has raised rates into declining growth it has been bullish for gold and when raised into accelerating growth it has been bearish (current outlook is raising rates into declining growth)

Asset Returns in Rate Hikes

Headwinds

Higher nominal interest rates

Real rates have a -0.82 correlation - When real rates go up, gold goes down

Possible stronger dollar

Russia/ Ukraine deal (temporary headwind)

Opening of supply chains drives down supply side inflation faster than expected

Tailwinds

Persistent inflation due to persistent demand and/or continued supply side pressure

Continued geopolitical uncertainty, driving up volatility

Demand from world central banks

Fear of stagflation or impending recession causing outflows from equities

Rising Rates Projections

There remains some concern that with inflation expected to come down, and rates rising, that this will put pressure on Gold, and this is very possible going forward, but we estimate that inflation readings will continue to come in at the high end of estimates for the medium term and that the fed funds target will overestimate the actual targets.

*source: Bloomberg, US Federal Reserve, World Gold Council

As seen in the graph, projections often are higher than actual. As economic growth continues to slow in 2022, we postulate that the Fed will continue to raise rates, but cautiously. Growth will suffer, and if growth is significantly below estimates, this could trigger the Fed to adopt a more accommodative wait and see policy. Furthermore, gold’s price is not only dependent on the CB moves in the US, but also in other countries, which are likely to remain more accommodative.

Supply Side Inflation

Inflation, while expected to improve, will likely linger on longer than expected. The current spike in inflation is both demand and supply side driven. By increasing rates, the Fed is only able to attempt to control demand side.

Supply side factors influencing inflation include:

China supply chain, which is again experiencing problems as China issues rolling lockdowns. The original supply shock from China was never resolved, and now new lockdowns threaten that timeline of reopening

Russia conflict and sanctions causing pressure on commodity supply and prices

Energy/Oil supply

The Global Supply Chain Pressure Index

Sources: Bureau of Labor Statistics; Harper Petersen Holding GmbH; Baltic Exchange; IHS Markit; Institute for Supply Management; Haver Analytics; Bloomberg L.P.

*Supply chain pressure remains high and will take time to untangle. It has been shown to be resolving far slower than was expected even before the new rolling lockdowns in China and the Russia conflict. Inflation will come down, and increasing rates will help, but it will remain elevated in 2022.

Historically Gold has Out-Performed S&P in Times of High Volatility/ VIX Spikes

↑↑ = >20% move ↑↑↑ = >40% move

While recession may be some time away, or never manifest, if one believes recession is coming, gold would be once again expected to outperform the S&P

Increased Demand

Gold ETF inflows- Increasing (35T in Feb)

Central Bank inflows – increasing

Asia retail demand – increasing

COMEC Net positioning – highest since Jul 2020 (as of March 1 2022)

Miners

In 2021 demand was 4,021 metric tons, while mine production was 3,560metric tons, and total supply of gold in 2021 fell 1%. Also miners in 2021 reduced aggregate hedging positions in 3 of the 4 quarters of 2021, indicating a belief that gold prices go higher. The current aggregate producer hedge is less than 150T, which is the lowest since 2014.

Total All-In Costs for production across the mining industry averages between $11,000-12,00, and any rise in the cost of gold above this, is profit for miners. Ife price of gold increases, the miners profits increase exponentially and we expect share prices, and dividends, in miners to rise accordingly

Analysts Price Targets

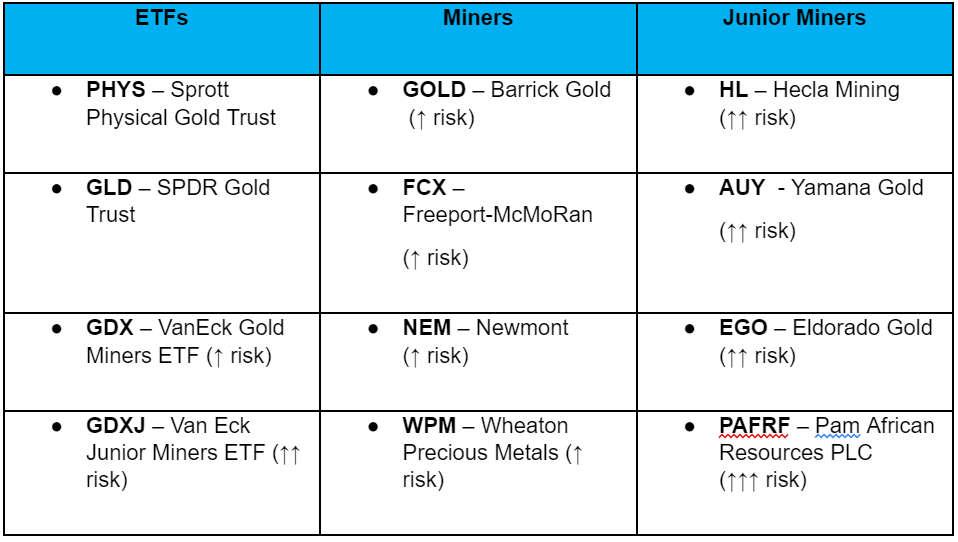

Specific Gold ETFs and Miners I am watching, have positions in, or trade in and out of:

*I also maintain a bullish outlook on silver in the medium term, maybe even more than gold.

Summary

I maintain that in the medium term (2-6 months) gold remains an attractive investment. The impact of rising real rates does pose a concern, but historically in a raising rates cycle gold performs well. Over the medium term, I continue to believe economic growth will slow. Raising rates into this increases the risks of stagflation. With the economic outlook, coupled with geopolitical landscape, I believe gold will remain strong. Any resolution to the Russia conflict will likely cause a pullback in gold, as will the Fed announcement of 0.5% hike. A short-term pullback in gold would not surprise and is expected. This can serve as a buying opportunity.

Scheduled Market Events This Week

Watchlist or Held

Disclaimer : This newsletter or information within does not in any way represent investment advice. The reader bears responsibility for any investment decisions, and should seek the advice of a qualified professional before making any investments. Owners/authors of this newsletter are not certified as registered financial professionals or investment advisers. The newsletter is for general informational purposes and entertainment and none of the information contained in the newsletter constitutes a recommendation of any particular security or investment strategy. The Owners/authors of this newsletter accept no liability for any direct or indirect loss arising from use of information within the newsletter. Subscribing to or reading the newsletter, or any future publications, constitutes agreement to these terms and reader agrees to release and owners/authors harmless from any losses or damages as a result of reading this newsletter or on any information contained herein, or in any communications including but not limited to tweets, emails, or other internet posts.

love being a subscriber.

also wondering will there be any comments on bitcoin in the future?

Happy to subscribe. You deserve every penny. Thank you!