The MoneyMaker

When Doves Cry

Follow @CordovaTrades✨ and special guest star @SLMacro on Twitter and if you’ve found this helpful, please spread the word!

Summary of Last Week:

Last week on YouTube I alerted you to a giant weekly bullflag within ES/SPX futures and gave you a range for what I would consider to be resistance for the breakout 4494-4520. Despite my looking for a nice pullback to test bull resolve, the momentum was resoundingly up.

I gave range pivots for NQ with 14345 being the bull/bear key and the next resistance level at 14841. The high of the week was 14840.50. (Wuuuut?!🎯)

I gave range pivots for RTY with the high level being 2096.8. The high of the week was 2097. (Holy crap!🎯)

I was bullish gold, silver and miners despite most people that I follow forecasting that gold would decline or be range bound. They moved up nicely. I reviewed GDX levels with the next resistance level being 39.43. The high of the week was 39.37. (Geez Louise!🎯) I live alerted on my public Twitter when I took some profit off near there.

I was bullish crude oil and natural gas for the week and they both went up significantly and respected my pivots well. I gave the next resistance level for XOP at 138.47. We closed the week at 138.60. (I’d say that was pretty good!🎯)

Here’s how the week closed out:

For the week ahead (3/28 - 4/1/22)

While I retain a core holding of GDX (trimmed on 3/24) and have a longer term bullish outlook for precious metals, I believe the most high probability trade for the coming week is for Gold to close the week lower. I think it may be consolidating in a bullflag on the weekly chart. Similarly I also believe Oil will close the week lower. Because both of these are counter trend trades, I will outline the conditions for which I will reverse these biases in the individual charts.

While $ES has marginally broken out from the weekly bullflag and closed right at the 20MA, $NQ remains within its bullflag resistance. $RTY is still within a weekly bearflag. Because there are mixed signals, my plan is to continue trading the indices on a level to level basis while hedging current longs for volatility at resistance levels. While generally speaking many macro types would consider my biases above of lower gold and oil this week to be ‘risk on’, if indices decline as well, I expect that decline to be substantial.

I have been bullish Natural Gas for some time and intend to buy dips. It’s a very twitchy commodity that is highly volatile and many people do not trade it because of the large and seemingly random and extreme movements. It’s a high risk commodity to trade.

$ES/$SPX/$SPY

$ES has marginally broken out of the weekly bullflag and closed a hair above the 20MA. There is now some support directly under the close at 4527.75 - 4521. Below that support a backtest of this flag breakout is likely at 4467.50. Should price action dip much below there the ‘OK’ or key level for bull/bear price action is 4380 where I would expect bulls to attempt a fierce defense should we get there. If price continues to the upside, I do not have many obstructions before the next resistance at 4717, although some consolidation and chop respecting support levels would be healthy.

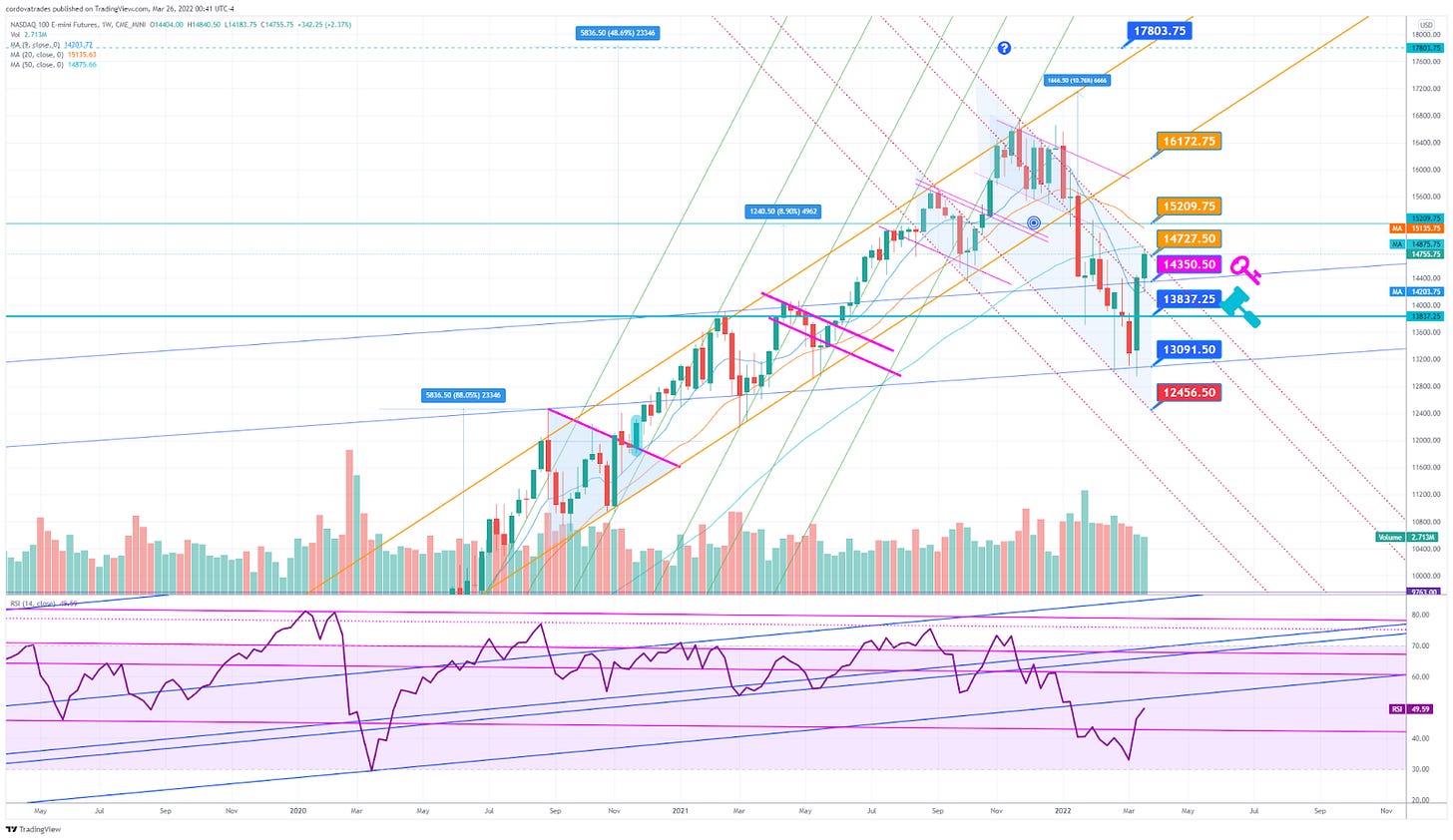

$NQ/US Tech 100/Nasdaq

$NQ perfectly respected my weekly resistance last week with a high only .50 off! Friday’s strong close leaves $NQ in a position that even if it opens flat it will have broken out. That wouldn’t give a lot of room for a backtest though. The next level of resistance is 15209.75 and above that a backtest of the longtime upward channel $NQ fell from would be at 16172.75. Similar to $ES, support is directly below the past close at 14727.50. I consider $NQ to be bullish above the key pivot of 14350.50. A backtest there would be a very interesting level to watch. I would expect that the hammer pivot of 13837.25 will be fiercely defended if price action takes us there.

$RTY/$IWM/Russell 2000 Small Caps

$RTY is the only one of the 3 major indices that closed lower week over week, although not by much. Last week’s high was 2097 vs the resistance pivot shared prior of 2096.8. It remains ensconced in a bear flag structure until price action is above the key pivot of 2102.2 and range bound unless price fails the 1939 level. The next resistance if price were to break upwards is aligned with the 20MA at 2126.2 with another minor resistance above that of 2167.2 before a very heavily defended resistance of 2222.1.

$GDX/Gold Miners ETF

$GDX is in a strong upward trend and has been consolidating the past couple of weeks. I took some profit last week near the 39.43 resistance. Like gold, the miners look to be consolidating in the form of a bull flag. I will add back part of what I took off at the 37.13 line if we get a backtest and below that the weekly 9MA. If price gets much above the 39.43 level and looks to be holding on smaller timeframes I will suck it up and add back what I sold above that resistance. 41.42 will be a tough nut to crack without some good consolidation.

$GC/Gold futures/$GLD

Many thought Gold had put in a death knell candle a few weeks back, but my bullish bias for last week turned out to be correct. For this week I am expecting a decline as part of a healthy consolidation. Ideally for longer term bulls the open gap in the 1887.6-1892.2 area gets filled and provides an opportunity to reaccumulate any sold at higher resistance. I plan to BTFD if it gets there. Much above 1969 and my thesis for this week will be incorrect and 2054.6 could come quickly.

$SI/Silver/$SLV

Silver has had a very bullish few months and it is consolidating on the weekly timeframe. Ideally bulls will get the chance to consider buying the dip at the 24.015-24.155 gap area in the event of a price action downdraft. As long as price remains above the 20MA the trend remains in the upwards direction. If price action breaches the 26.375 level this week, I would then expect some tough resistance at the 26.94 area as it’s an intersection of resistances.

$CL/Oil/$XOP Oil Equities ETF

I was bullish oil last week and the high of the week just barely eclipsed my line before price action receded. Just like with gold, I believe that this week’s price action will decline and consolidate and it’s a well defined setup. If price is above 116.53 I will wait until back below to take the short. If price reaches 122.60 I will short with tight stop. Much above 126.63 and new highs will likely be imminent. $XOP has reached it’s measured move from the upwards channel breakout. If it starts to decline and I decide to take the short, that 138.47 area would be my stop.

$NG/Natural Gas/$UNG

Ideally I’d like to see Natty hold the two dotted yellow levels it closed above this week. I would love to attempt to rebuy what I sold on a dip down to the 5.199 area. The next resistance is 5.855 and above that I believe new highs will be coming. Anything above the 4.555 level would still be in the new uptrend channel. Not bearish until below there.

Big Picture Macro - When Doves Cry

· 3/16 Powell updated that the Fed would be raising rates 0.25%. With inflation surging, the Fed is left with no other option than to talk hawkish. Given the level of inflation, the Fed will be aggressive in the short term to maintain any semblance of control. Trust that the Fed can and will act is of utmost importance. Ultimately, inflation will start slowing, but without aggressive intervention, or the forecasting of it at least, it will not come down fast enough. The Fed knows raising rates will slow growth and hurt markets. They can only affect demand side not supply side.

· The issue is the environment we are in – High inflation, and raising rates into a slowing economy – We think for the medium term this puts pressure on the market, the same market that has bounced hard since Powell spoke. SPX is up 6.5% while QQQ is up 9.46%

· This is a chance to exit tech heavy growth stocks on bounces and position for the coming environment (Growth slowing and inflation slowing) – remember rate of change is what matters

· What will be under pressure – Momentum stocks, high beta (high volatility), nonprofitable growth companies

· What we believe will outperform is what has historically in this environment – Healthcare, defensives, low beta, gold/precious metals

· While our current account is highly concentrated, aggressive, and volatile, we believe our returns will trump the general market returns. If we were not actively trading, we think we would still outperform the general market by positioning as below:

Scenarios on approaches for the coming environment (2-6 months) as long only investors, long/short investors, and active traders

· Long only

Conservative: sell high growth nonprofitable companies on bounces to lock profits, add XBI, LMT, VDC, XLP and other defensives, XLU, SPYD, GLD, GDX, SLV

Aggressive: LABU, GDXU, SIL, LMT and a handful of high dividend and biotechs

· Long/Short

Conservative:Paired trades short QQQ/ long XBI, short XLK/ Long XLP or XLU, short IWM/ Long GLD. Paired trades not always held at a 1:1 position

Aggressive: SQQQ/GDXU, QQQ and IWM puts (timing important) paired with GLD and SLV calls, SQQQ/LABU (sizing not 1:1)

Scheduled Market Events This Week

Watchlist

Disclaimer : This newsletter or information within does not in any way represent investment advice. The reader bears responsibility for any investment decisions, and should seek the advice of a qualified professional before making any investments. Owners/authors of this newsletter are not certified as registered financial professionals or investment advisers. The newsletter is for general informational purposes and entertainment and none of the information contained in the newsletter constitutes a recommendation of any particular security or investment strategy. The Owners/authors of this newsletter accept no liability for any direct or indirect loss arising from use of information within the newsletter. Subscribing to or reading the newsletter, or any future publications, constitutes agreement to these terms and reader agrees to release and owners/authors harmless from any losses or damages as a result of reading this newsletter or on any information contained herein, or in any communications including but not limited to tweets, emails, or other internet posts.

Your ebullient personality had me hooked from the start. Some people write research because their personalities are dry as dust but you have a warming presence that will be sadly missed. Not many people can make a viewer feel as if they’re sitting next to you, planning the week ahead. I still freakin’ love you, and your content. :)

Thanks Julia. A wealth of information to get ready for the trading week!