Building A List

A Look at Long-Term Holds

Buy And Holds

Over the past three weeks I started write ups on companies that are attractive to me over the long term. While we continue to have macroeconomic challenges and have technically entered a recession, I have begun to buy companies or build watch lists of stocks that I think will outperform over the next 3 to 5 years. I will caution that in the short term these companies could continue to experience volatility and lower realized prices, much like the rest of the market. That said, I think lower prices are opportunities to build positions or add to existing ones.

Thus far I’ve profiled GOOG 0.00%↑ , ENVX 0.00%↑ and in this note I’ve included a look at CWH 0.00%↑. We also took a look at CCJ 0.00%↑ in our Uranium note.

Google Me ($GOOG) - released 7/10 for members.

by @SLMacro

While awaiting a Fed pivot I have started making a list of companies that appeal to me. In the current environment I have remained with a large position in cash and have been actively trading in and out of bullish and bearish positions. I have had very little long term holds outside of a few speculative stocks and sectors like defensives. In bull markets, my strategy is different, and I am much more comfortable adding and holding longer term positions. The next few articles, I plan to dive a bit deeper into some of the companies on my long term add watch list, which range from tech giants to small speculative companies.

Of all the big tech companies, Alphabet ($GOOG) is the most intriguing to me. In my opinion it is best positioned from a growth, innovation, and future revenue perspective. The bread and butter is search and advertising which it dominates. It has a near monopoly in the search engine optimization space and the largest driver of revenue for Alphabet is from Google ads. The second largest driver of revenue is YouTube advertising followed closely by Google cloud revenue. While the cloud growth has been enormous, growing 44% y/y, there have been concerns in the recent miss in YouTube ad revenues. I personally believe the YouTube miss is overblown, despite the growing competition from TikTok and streaming services. I believe other divisions and cloud growth will help supplement any near-term losses from YouTube. Given anti-trust fears, Google has already begun discussing a spin off of its advertising businesses, which in my opinion will actually unlock lots of value for shareholders. I do not believe that many of the other currently nonprofitable ventures Alphabet is working on are accounted for in the valuation of the company, and a spin off would help unlock some of this value. Alphabet has one of the largest R&D budgets out of all the large tech companies, and outside of the ads and cloud space, they are working on countless projects to innovate a number of industries, from AI to healthcare to defense to banking to autonomous driving and more. They have countless shots on goal and are building a large moat that in the future will drive increasing revenue and profits. I would not be surprised with short term pressure sure to the recessionary environment though. One of the first things to decrease when growth slows is ad spending. Any ad spend pressure should be short lived though when looking at the bigger picture.

Software

While the company dominates the consumer electronics software space with Android, it has been unable to compete with Apple in the hardware space. Alphabet has realized this, and instead of pumping money into its hardware divisions, it has doubled down in the AI space and software, banking that this will make it a differentiator in the future. From apps like Maps and Assistant to integration with TV, watches, and automobiles, Alphabet is banking on a future of an interconnected world, building on it’s dominance with Android OS, which has been the best-selling mobile OS since 2011, and today owns a 72% market share in the smartphone space. There remains significant untapped potential in their wearables division, which has not been able to yet capitalize on its acquisition of Fitbit last year. In the TV space, I expect the Android TV division to be merged with the Chromecast Google TV division to unlock synergies. The smart home division is yet another area that I expect to continue to grow within company’s ecosystem. Since acquiring Nest Labs in 2014, they have had a hand in the climate control, security, and remote monitoring space and I expect Alphabet to continue to grow revenues and market share here. Another future gem in the Android ecosystem is Google Assistant, which has consistently been rated better than its main competitors Cortina and Siri. Google has heavily invested in machine learning, so that Assistant can pick up on variations in speech. Automakers including GM, Nissan, Volvo, and Fiat Chrysler have taken notice and have begun integrating Google Assistant, Maps, and Play Store into their vehicles. Overall, I believe this focus by Alphabet on supplying software to 3rd parties is a wise and sustainable move.

Quantum Computing

While Alphabet seems to be focusing on software for the present day, they are indeed making a play for the future of hardware with their work on AI and quantum computing chips and systems. Google has had a large head start in this space, beginning work on it as far back as 2006. The have partnered with D-Wave, one of the largest players in quantum computing, and NASA and have made great strides in the space. Google is developing custom chips and integration software to allow 3rd party users to run complex computer models and experiments remotely. In the future I expect this technology to be used in countless applications from modeling of diseases and pharmaceutical testing to robots to the creation of new materials. Machine learning, AI, and quantum computing will be an enormous industry in the future and Alphabet is positioned to be a leader in the space.

Healthcare

One of the areas that Alphabet has really leveraged its machine learning and modeling is healthcare. They have partnered with a number of other companies, and are working on realistic solutions to problems in healthcare. Alphabet currently has projects around diabetes, cancer, wearables, robotic surgery, pharmaceuticals, and population health. In diabetes for example, they have been able to utilize software to accurately diagnose diabetic retinopathy. With regards to cancer, they are now able to analyze images of breast tissue and identify cancer with 92% accuracy. Alphabet has been able to analyze mammograms screenings and significantly reduce the incidence of false positives and false negatives. They also continue to develop software that utilizes machine learning to find cancer markers in bloodwork before they would traditionally be found from conventional testing. Alphabet is also partnering to revolutionize clinical trial space. Clinical trials today require control groups and experimental groups, and traditionally this has required significant investment in recruitment of patients for both groups. Alphabet is involved in a project called Project Baseline which has crowdsourced health information from 10,000 volunteer patients daily over the course of five years, collecting data at a level of detail that has never been seen, including sleep habits, mental state, vitals, blood work, urine analysis, genomic composition, and more. The thought is to be able to create virtual control groups for use in clinical trials. Companies like Sanofi, Pfizer, and Novartis have also joined Project Baseline. Alphabets venture into the healthcare space is enormous and commands a large portion of the company’s R&D budget. In my opinion the money is well spent, and will pay dividends in the future.

Autonomous Driving

In 2009 Google bought Waymo, and today the company is thought to be the industry leader in self-driving. The company has logged the most autonomously driven miles of any company and is the only company that currently operates a self-driving ride service, Waymo One. It is currently operational in Phoenix with future plans to roll out to other areas. Waymo cars have driven more than 20 million physical miles and 15 billion virtually simulated miles. Their business model for autonomous driving in my opinion is also much more scalable and sustainable. Instead of building their own vehicles, Alphabet is looking to partner with existing automakers. This allows the company to devote all of its attention to perfecting self-driving software without having all the worries associated with car production.

YouTube TV

While there were concerns in the most recent earnings report about YouTube ad revenues, I think the space will continue to grow, even if Alphabet continues to lose streaming market share to Netflix, TikTok and other services. In my opinion the creation of YouTube TV will allow another avenue of targeted ads in the future, something that could never be done in the past with traditional television. This service will continue to grow as people cut the cord. YouTube TV allows far greater accessibility and portability when compared to traditional broadcast television.

Finance

Yet another sector Alphabet continues to push into is finance. Google pay has been the largest financial product they offer to date and has close to 80 million users and is available in 40+ countries. In 2022 they increased their reach with expanded functionality to pay for things like parking and ride fares. They integrated with Western Union for seamless money transfer abroad and also are partnered with a number of major banks, managing their cloud services. They did scrap their plans for Google Plex, which was set to partner with Citi Bank to offer zero fee checking accounts, though I would not be surprised if this is revived in the future.

Others

There are several other areas that Alphabet has a play on. While I won’t be covering them all in depth, they are worth briefly mentioning at the least. Satellite imaging is a space Google has been in for many years, and they have invested in this space and are providing imaging services to governments and private companies. The imaging data can be used in a wide array of areas, from evaluating domestic or worldwide crop yields to traffic patterns and city planning. Alphabet has also made a play on the defense sector, and their technology has been used to try to improve accuracy of drones and interpret data collected by them. There was blowback from this partnership internally and Google did not bid on JEDI contract that Amazon and Microsoft are currently arguing over. As Alphabet continues to make advances in quantum computing, AI, and machine learning, and autonomous driving, I expect more future partnerships with the Department of Defense. Gaming and travel are other areas that the company is tackling.

Financials

Despite a recent earnings miss, I suspect that this is short term pain but long term noise. Revenue last quarter still increased around 23%, despite a very narrow miss with revenue of $68.01 billion vs an expected of $68.11. Earnings per share were also down by about $1 but remain enormous at $24.62. EBITDA also increased for the quarter by 24.49% year over year. Total assets increased by 9% to $357 billion while liabilities increased 6% to $103 billion. Free cash flow from Q1 was up 34.69%. Price to book is 6.2, compared to AAPL at 35.4, AMZN 8.77, and MSFT 12.3. GOOG has a PE of 21.7, compared to AAPL 23.9, AMZN 55.8, and MSFT 27.9. The 52 week low was 2,045 in May 24th and since then the stock has bounced to 2403.

Summary

In my opinion, Alphabet is valued based on its search engine, ad, YouTube, and cloud business. These are the current money makers for the company, but they have their hands in countless other jars that could be large revenue drivers in the near as well as distant future. When compared to its peers, I believe Alphabet represents both a better value and growth proposition and I will be using pullbacks to accumulate for long term holds. Short term there will likely be continued pressure to do decreasing ad spend but if the Fed pivots and the market is able to exit a bear market, I will be willing to pay more for the company. In the meantime I will be watching closely and adding on pullbacks. If we test the 2000 range again or below, then significantly increasing my holding in GOOG will be a no-brainer for me.

*GOOG had a 20-1 split since the article and that “load-up zone” is now $100.

100% Charged - A look at Enovix ($ENVX) - released 7/17 for members

by @SLMacro

In the most recent release, I began my discussion on stocks that are appealing to me long term. For me that means over the next 3-5 years. Last week I discussed Alphabet ($GOOG) a large blue-chip company. This week I will focus on a much smaller, speculative stock $ENVX. While the current macroeconomic environment is unkind to nonprofitable tech companies, in my opinion Enovix Corporation is well positioned for future growth and profitability. I currently do own $ENVX shares and think it remains a strong buy in the $7-11 range. This stock may require some patience though, as it is the exact type of company that will sell off in a sustained market downturn. Increasing rates and slowing economic growth are poison to speculative tech companies. For the long term though, this pain could produce very attractive buying opportunities.

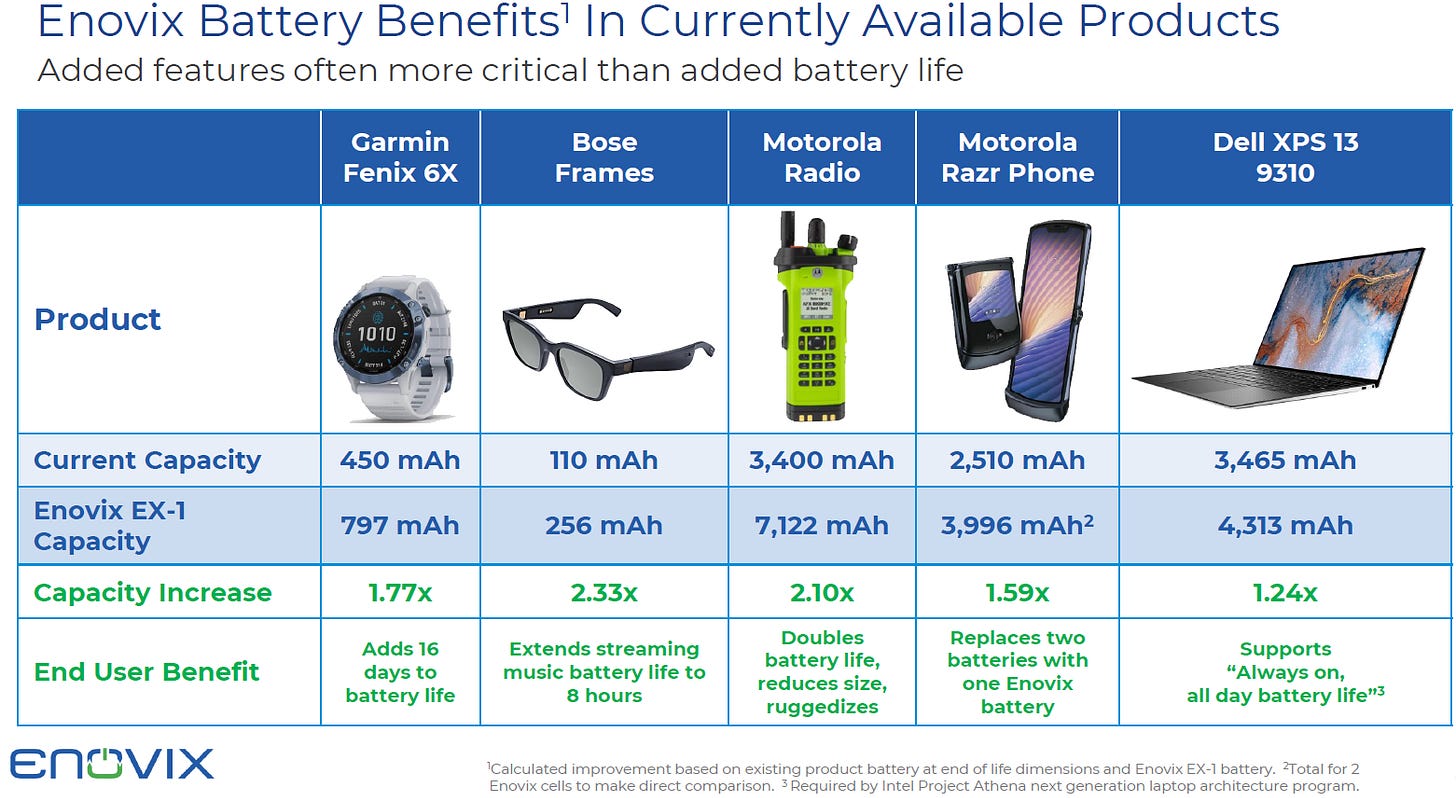

When looking at companies, I like to look at disrupters, and Enovix is positioned to do just that in the battery storage space. Enovix designs, develops, and manufactures next generation 3-D silicone lithium-ion batteries. They have redesigned battery architecture to double storage density while also solving major battery issues including battery swelling and thermal runway. We have all seen reports of lithium-ion batteries swelling and spontaneously combusting, well that is because of battery swelling and thermal runway. Enovix has appeared to solve this issue and has figured out how to generate a more stable, longer lasting, and higher capacity battery. They are the first to have developed a 100% silicone anode, allowing the battery to store twice the lithium traditional graphite lithium-ion batteries can store. This means double the anodes can be packed into the same battery size, driving up energy density. Other companies though have not been able to figure out how to create a silicone anode, and current technology does not allow for silicone to be used in traditional batteries.

The increased energy density offered by the new battery technology has countless applications, from wearables, to cell phones, laptops, VR, and EVs. The team at Enovix realizes this opportunity. They are far ahead of traditional battery makers, including Samsung, LG, and Panasonic and are making a play on the industries mentioned above.

Enovix took a long road to get to where it is at today. It has taken over 15 years of R&D to develop their current battery technology and the company currently holds over 100 patents and has over 100 patents pending. They spent years developing the core technology and cell design. This was followed by the development of a manufacturing process that could be scalable. Now the company has arrived at the validation and production phase. They recently announced a deal with Garmin, to supply batteries for smart watches, moving the company from proof of concept to commercial availability, something other competitors who claim battery breakthroughs are years away from. Enovix has made great headway with customers. It has multiple clients who have funded custom battery designs or are in the process of qualifying batteries for products that will use an Enovix 3D cell. These total $371 million of potential yearly revenue. Another $1.1 billion of potential yearly revenue exists with other companies that have determined Enovix is applicable to their products, and who are actively evaluating adopting the cell technology. It appears the Garmin deal is the tip of the iceberg. There have been unconfirmed rumors of major companies such as Apple and Meta also engaging with the company. The company has also been involved with the Department of Defense over the past year. Ultimately by 2025 they plan to have made a move on the EV market and recently added a team member who previously secured several multibillion dollar contracts with customers such as Stellantis (Fiat-Chrysler), Rivian, and Ford.

$ENVX is off its highs significantly and has suffered in the recent market decline. Despite the substantial pullback, the company appears to have stabilized for the time being. The company continues to have 56.4% institutional investment and in most recent filings had 36 new positions opened based on new 13Fs. 68 fund increased positions, representing an 84% increase from prior quarter, while only 18 funds decreased positions and 18 funds closed positions. 23 hedge funds added new positions, representing a 76% increase from prior quarters. On May 23rd, independent director TJ Rogers added 100,000 shares, at an average value of $9, increasing his ownership to 400,000 shares. At the end of June, $ENVX joined the Russell 2000 and 3000. Cowen recently maintained its “outperform” rating on the stock, with a year price target of $20 and currently 5 analysts are covering the stock with a consensus “buy” rating with average estimates of $29.60 with a high forecast of $38 and a low forecast of $20.

Ultimately, I believe Enovix is positioned to become a leader in battery technology. They have a revolutionary product and first mover advantage. Any competitors are years away from functional and scalable products. It is important that Enovix can capitalize on this and that they scale up manufacturing capabilities to support growth. In my opinion, even at current levels, the risk/reward ratio is attractive. Buyers though likely have time to build positions, as a strong move to the upside is unlikely until the overall market sets a bottom. If the general market takes a further downturn, $ENVX will indiscriminately follow and there is a decent chance recent lows are tested again, or even broken. I plan to use those opportunities to add to my current position and lower my cost of entry.

Lets go Camping - A look at Camping World Holdings ($CWH) - 7/28

by @SLMacro

The last 2 weeks I started a discussion of companies that interest me. While the bear market continues, and a test of lower lows is quite possible, I am building my buy list of companies that look attractive. What draws me to a stock can vary. The first stock I discussed, $GOOG, is attractive to me as the best of the “blue chips.” It is positioning itself for the future by building a large moat and investing in innovation. $ENVX is attractive to me as it is building a “better mouse trap,” and innovating battery technology. It has first to market advantage. This week I discuss $CWH. The company is attractive to me for a variety of reasons, but most importantly it is a cash cow, the valuation is extremely attractive, and the dividend is enormous.

Camping World Holdings ($CWH) is an American company that specializes in selling RVs, RV parts, and camping supplies. They are a one stop shop of any RV needs, from buying new, buying or selling used, repairs or additions, and also are the parent company to Good Sam Club, the largest organization of RV owners in the world, with over 2 million members. $CWH went public in 2016 and is run by Chairman and CEO Marcus Lemonis, of The Profit fame on CNBC. They last had earnings in May and revenue grew 7.1% Y/Y. The company faces some significant short term macroeconomic challenges but on the other end offers a very attractive dividend of 9.5% to help navigate troubling times.

Headwinds

The biggest obstacle for $CWH to overcome is the economic landscape. We are in a time of very high inflation and headed have technically entered a recession and discretionary spending is decreasing. Recreational spending by consumers is expected to decrease. AAA expects travel for the remainder of 2022 to be at 40-year lows. Baird reported a 31% decline in RV sales in May. Total RV shipments are expected to be 8% lower than 2021 according to RV Industry Association (RV IA). In Q2022 $CWH did have declining new RV sales, but it combated this by maintaining strong sales in used RVs and continuing to execute on the services and repair side. Repairs remain overbooked, and demand on the services side is strong. They continue to expand with 11 more dealership locations by the end of 2022. The new stores are expected to add around $500 million to revenues once fully mature in 16-24 months. For over 50 years, every decade has had increasing RV purchases compared to the prior decade and short-term noise may demonstrate an opportunity to buy. With margins north of 30% (great for the industry), $CWH remains well positioned to navigate short term macroeconomic downturns.

Financials

· Q1 Revenue $1.7 billion, an increase of $104.6 million (↑6.7%)

· Q1 Adjusted EBITDA $183.1 million (↓ 3.8%)

· Q1 EPS $1.15 (compared to $1.40 in 2021, though 2021 they realized some tax benefits)

· Dividend $0.625 or $2.50 annualized to 9.5% Yield

· PE 4.7 (Industry near historical lows)

In my opinion the company will likely have a challenging Q2 and Q3, but I expect the services side to keep revenues strong. I would not be overly surprised with 52-week lows being tested again this year should we have a deep recession, and it is possible in the near future $CWH is relative dead money. That said, the dividend of 9.5% and buyback program should serve as some support the next few quarters and I think sharp pullbacks can be used as buying opportunities.

Sentiment

$CWH continues to have high short interests at 26%. It did see a decent decrease in short interested of June when compared to June 15. Avg days to cover is 7.6 and 9.8 million shares are sold short. At the end of April short interest got as high as 42.14%. The CEO Marcus Lemonis continues to have belief in his company, and June 10th he bought 38,350 shares with an avg price of $26.36. The total transaction was for $1,010,906. Abrams Capital Management is the top shareholder, with 12.25% ownership valued at $133,544,241. This is followed by HG Vora Capital Management with 10.07% ownership ($109,788,000). This was a completely new position opened in Q1 of 2022. Based on 12 analysts in the last 3 months, the average price target is $36.33 with a high estimate of $50 and a low of $26.

Summary

Overall, I believe that $CWH presents a compelling case for my long hold portfolio. I have owned the company in the past recently initiated a small position. I will be looking for opportunities to add to positions on deep pullbacks, especially if we test lows again. The dividend is extremely attractive and sustainable. Marcus Lemonis is an excellent manager, and I expect him to be able to guide the company through the current recession. While Q2 and Q3 may show some revenue contraction, the share buyback program and dividend should keep investors relatively comfortable. Once the recession is over, I expect this stock to take off and believe in good times this is a $60+ stock. Any entry here or lower in my opinion is an opportunity for long term holders.

Long Term List

*GOOG price displayed post-split (7/15/22)

Disclaimer : This newsletter or information within does not in any way represent investment advice. The reader bears responsibility for any investment decisions, and should seek the advice of a qualified professional before making any investments. Owners/authors of this newsletter are not certified as registered financial professionals or investment advisers. The newsletter is for general informational purposes and entertainment and none of the information contained in the newsletter constitutes a recommendation of any particular security or investment strategy. The Owners/authors of this newsletter accept no liability for any direct or indirect loss arising from use of information within the newsletter. Subscribing to or reading the newsletter, or any future publications, constitutes agreement to these terms and reader agrees to release and owners/authors harmless from any losses or damages as a result of reading this newsletter or on any information contained herein, or in any communications including but not limited to tweets, emails, or other internet posts.

ENVX will be a rocket, patience warranted & don't sell too soon